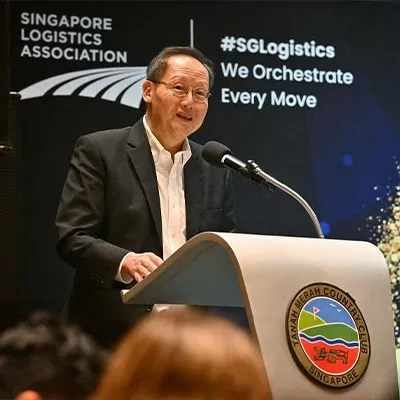

Singapore will introduce a new Refundable Investment Credit (RIC) for substantive, high-value economic activities, as part of the country’s investment promotion toolkit, said Finance Minister Lawrence Wong on Friday (16 Feb 2024).

The tax credit with a refundable cash feature will help Singapore stay competitive and attract investments from global companies with the right know-how, he said during his Budget speech in Parliament.

The RIC encourages companies to make sizeable investments that bring substantive economic activities to Singapore, in key economic sectors and new growth areas.

Supported activities include investing in new productive capacity, such as manufacturing plants; expanding or establishing the scope of activities in digital services; and expanding or establishing headquarter activities.

Other activities include the setting up or expansion of activities by commodity trading firms; carrying out new innovation and research and development activities; and activities in support of the green transition.

To support RIC and other investment promotion efforts, the government will top up the National Productivity Fund by S$2 billion this year, said Wong.

The Economic Development Board (EDB) and Enterprise Singapore (EnterpriseSG) will award the RIC based on qualifying expenditures incurred by the company in respect of a qualifying project, during a qualifying period of up to 10 years.

Qualifying expenditures are dependent on project type, and include capital expenditure, manpower costs, training costs, professional fees and intangible asset costs, among other kinds of costs.