Singapore

Singapore, the birthplace of DBS Bank, a digital pioneer whose recent plaudits include an AI-enabled virtual assistant called KAI, is the region’s most sophisticated market when it comes to digital transformation in the financial services sector.

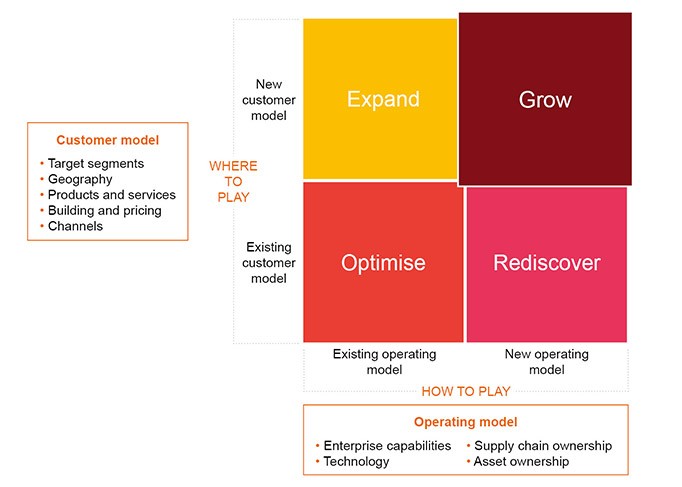

But Singaporeans are also advocates of good customer experience. According to PwC’s 2018 Experience is Everything report, 38 per cent of Singaporeans don’t believe that their needs are understood. Companies in Singapore need therefore to embrace a customer-centric business model and take the time to acknowledge specific pain points during every stage of the customer journey. Embracing ‘Enterprise Agile’, a type of operating model that supports customer-centricity – from strategic planning and funding allocation through to change and run activities – could empower companies in Singapore to innovate and service customers effectively and tap into new segments in the process.

Malaysia

In Malaysia, where 85 per cent of the population uses the internet according to a March 2018 New Strait Times report, the digital economy is full of promise. This potential is being enabled by nationwide investment in infrastructure: the government-led Malaysian Digital Economy Corporation (MDEC) is currently leading a program that champions technologies ranging from Big Data Analytics to the Internet of Things. But, an adherence to outdated legacy systems could prevent Malaysian companies in the finance space from becoming truly customer-centric.

Partnering with technology companies that have invested in digital capabilities and revolve around an agile way of working will allow Malaysian businesses to leverage the trust they have built with their existing customers. At the same time, it can create new value propositions.

Partnerships no longer just focus on distribution, but also the build of core enterprise capabilities. For example, a June 2018 article in Fintech Malaysia reported that the Hong Leong Bank has partnered with digital-first companies such as Kakitangan, a digitised human resources and payroll platform. Elsewhere, RHB has launched a suite of cloud-based platforms aimed at improving efficiency and empowering their clients to digitise their business.

Thailand

Thailand is defined by its contradictions. Even as players like the Siam Commercial Bank ramp up their investment in digital infrastructure, the size of the country’s rural makeup coupled with the fact that cash is favoured by 70 per cent of the population complicate any moves to a digital-first business model.

In Thailand, financial organisations have built long-term relationships with customers, who rely heavily on bricks-and-mortar branches. This creates serious barriers to agility. However, movers in the Thai financial sector can still reap the benefits of loyal customer relationships while starting a dialogue with the part of the population that prefers cash. For instance, companies can invest in personalisation and analytics technology to gain insights into the country’s vast range of customer segments.

Additionally, Bank of Thailand led initiatives such as PromptPay and centralised KYC (know your customer) accelerate development of digital capabilities and reduce infrastructure requirements. Capitalising on the country’s high degree of mobile penetration to provide user-friendly financial products to these customers via smartphone can let organisations keep their customer base while tapping into the unbanked market.

The Philippines

According to the Future of ASEAN report, GDP in the Philippines is projected to eclipse US$500 billion (S$685 billion) by 2022. But the country is also affected by factors such as poverty and a population that prefers cash payments. In the Philippines, the priorities are to create a sense of financial inclusion as well as to instil a sense of trust between people and financial institutions.

Despite this, the fact that the Philippines is also the region’s fastest-growing smartphone market is key to connecting with this customer base while moving towards a customer-centric business model in the years ahead. For example, prepaid phones can serve as a form of universal identification, allowing customers to sign up for products and services in areas such as banking and wealth management. The PwC report also shows a 25 per cent growth in e-wallet transactions across the country, which suggests that consumers may have a propensity towards going cashless in the future.

In July 2018, the Philippines rollout of Grab Financial — a financial services product pioneered by mobile-app based ride-sharing company Grab — is an example of how companies in the region can use the mobile channel to build credibility before converting new customers to financial services.

Laying the future groundwork

In South-East Asia, the successful implementation and financial viability of new business models are informed by a complex cocktail of factors. The development of regional hubs to serve ASEAN consumers, as well as the adoption of digital capabilities to produce and transport goods, and serve and communicate with consumers will be key factors for success going forward. Partnerships and alliances will also play a significant role, particularly cross sector and with industry disruptors, as companies try to stay relevant and competitive, and meet consumer expectations in a profitable manner.

On the customer side, an awareness of culture, language and customs – factors that can differ even from village to village – must exist in tandem with loyalty to local organisations, the population’s digital literacy, the rate of technological penetration as well as the level of trust between people and large organisations. On the operating side, companies should consider the capabilities of the local workforce, the quality of infrastructure, regional ownership structures as well as the ability of the country’s government to make decisions. In many cases, slow and inconsistent decision-making processes and a lack of transparency thwart even the most well-intentioned digital effort.

But for businesses in the private sector, this can represent a bold and compelling new opportunity to build innovative new business models that respect the diverse needs of a region’s customers and focus on starting conversations with the parts of the population that the digital economy has overlooked. It’s critical to remember that there isn’t a one-size-fits-all business model that will work for emerging markets in South-East Asia.

However, building a business model that’s defined by the context of each market, respects the customers that shape each region and the essential operational considerations across each country, can help turn digital opportunities into real-world success.

This article first appeared on PwC Digital Pulse on 24 October 2018.