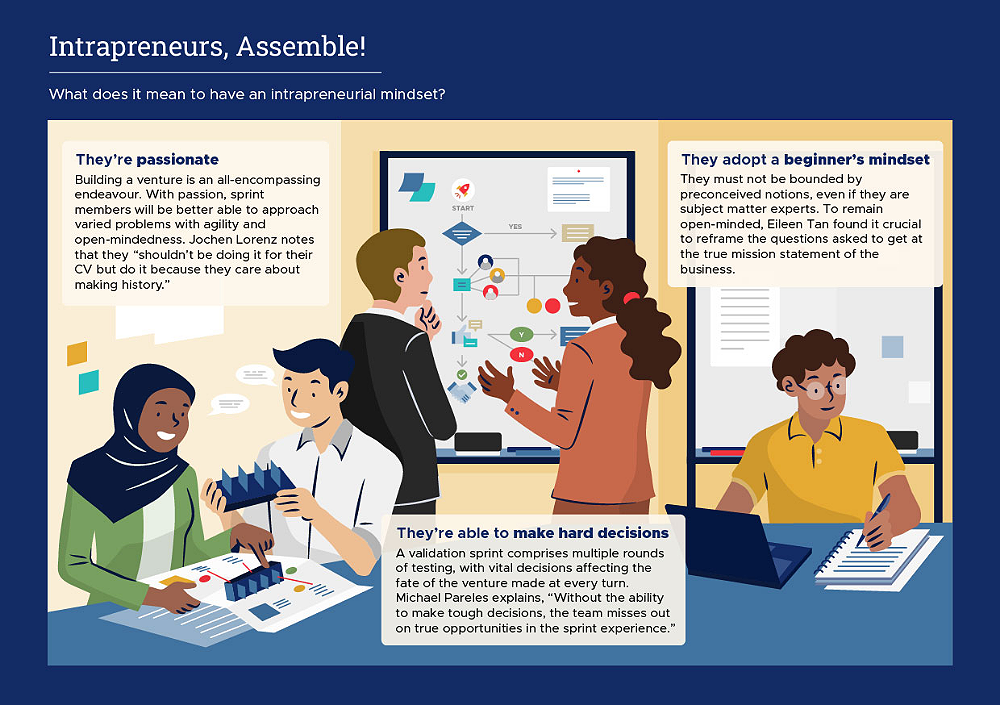

Panellists from left: Eileen Tan, VP, Digital Customer Experience and Analytics at SATS Ltd; Michael Pareles, Open Innovation Lead (APAC) at Bayer Crop Science; Belina Lee, CEO of Mandai Global and Deputy CEO, Transformation & Growth, Mandai Wildlife Group; and Alvin Cai, VP, EDB New Ventures.

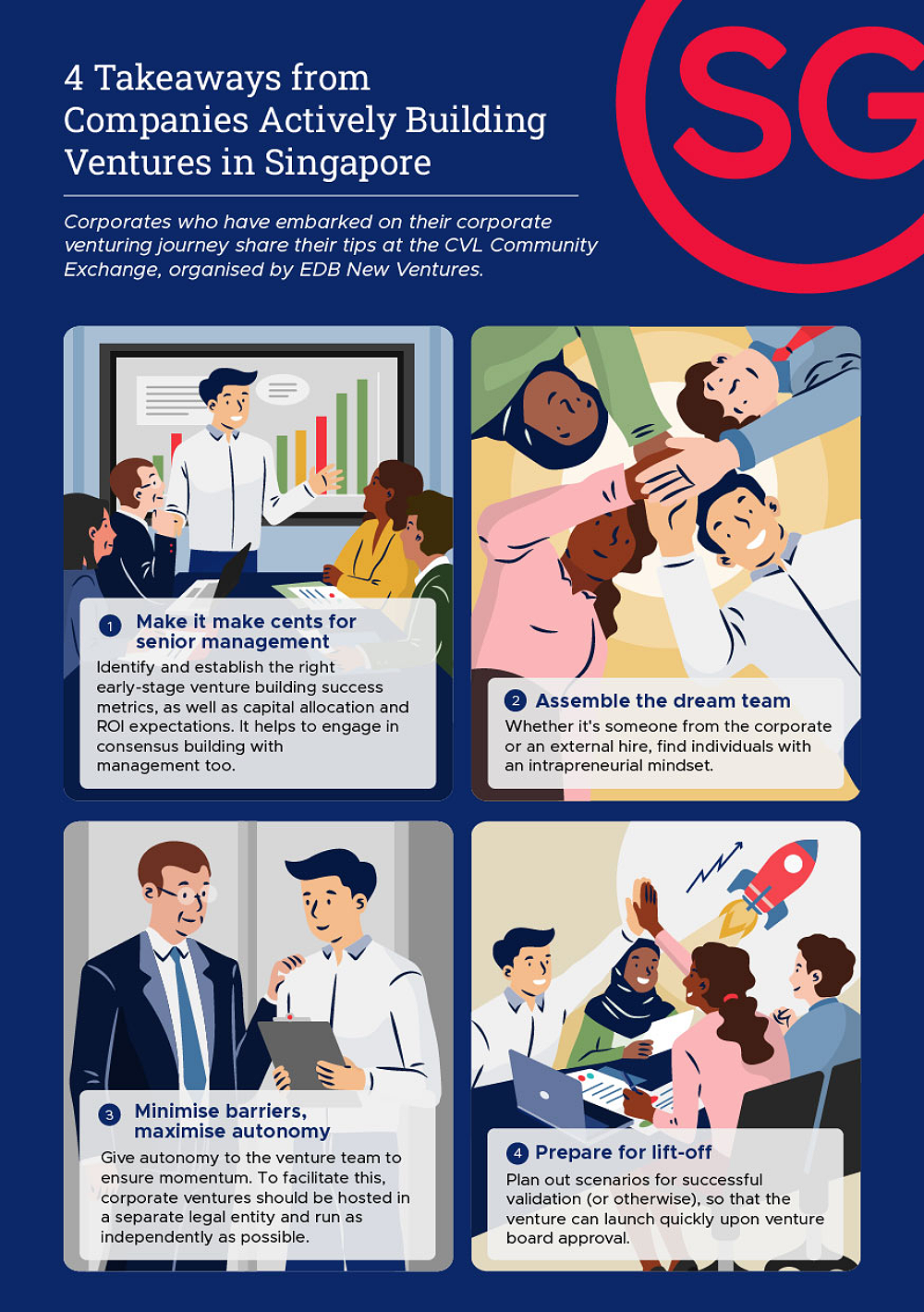

To stay ahead of the curve amidst market disruptions, companies are embarking on corporate venture building, where established companies build new capabilities beyond their core businesses. A 2021 Leap by McKinsey survey found over half of 1,178 business leaders across regions and industries placed venture building as a top-three priority, while a fifth ranked it number one.