Will Lee is the founder and Michael Chin is the CEO of the InterOpera group.

The traditional finance industry has been structured in a way that even the simplest of transactions will likely pass through layers of intermediaries, in an increasingly inefficient system with mounting costs and the risk of human error unmitigated.

As a result, the average retail investor bears more cost – assuming he or she even qualifies to participate in capital markets products – than an institutional investor. According to an ESMA report, retail investors pay 30% to 50% more in costs than institutional investors when investing in UCITS funds. This, in essence, amounts to financial exclusion.

DeFi is not the (complete) answer

DeFi, or decentralised finance, has rewritten the rules and relationships of traditional finance – increasing customers’ access to and direct control of their financial and investment portfolios while eliminating the middle layers of financial intermediaries. However, one thing DeFi does not afford is investor protection.

More than $10 billion worth of DeFi funds were stolen in 2021, a sevenfold increase from 2020. A decentralised ledger may make transactions immutable and transparent, but user identities remain shrouded in anonymity. Since there are no regulations or central authorities involved, and transactions are irreversible, victims of DeFi fraud or theft end up with no legal recourse.

While technology can powerfully and effectively create financial inclusion, DeFi in its current form cannot be the answer, since investor rights are still not completely protected.

Introducing a “regulated DeFi” infrastructure

Creating true financial inclusion for all requires a fundamental reconfiguration of the regulatory and technology infrastructure on which the financial industry is anchored, taking into account the need for transactional efficiency and security.

To this end, we invented InterOpera’s flagship product, Regulated DeFi Operating System (RDOS) – a universal multi-chain platform that facilitates tokenised trading of securities and digital assets within prevailing regulatory frameworks. While many fintech companies are trying to disrupt or even replace the current financial system in its entirety, the way forward as we see it is to bring together the advantages of decentralised user-centred blockchain ledgers and the safeguards provided by financial regulations and institutions.

In DeFi investing, where transactions are made without financial intermediaries, smart contracts are essential – these are programmes that automatically execute and create a record on a blockchain when certain conditions are met. RDOS leverages this technology, incorporating financial regulations as additional conditions, thus providing investors with an added layer of protection.

In short, RDOS is architected with smart contracts that ensure every transaction documented on blockchain inherently satisfies regulatory requirements such as:

- Verification of investor identity – Enabling the ”whitelisting” of investors based on Know Your Customer/Anti-Money Laundering/Countering of Financing of Terrorism (KYC/AML/CFT) and other global regulatory requirements, while keeping personal data secure and protected

- Product & investor suitability – Screening based on regulations applicable to local/overseas investments, investment classes, investor categories, etc.

- Tax implications – Calculating and processing taxes, and recording transactions in a retrievable format compliant with requirements of tax authorities

With RDOS in place, not only will investors have peace of mind, but authorities can be satisfied of the legality of transactions, and financial institutions can offer a more trustworthy and future-proofed service to their customers.

By harmonising regulatory requirements with demand for a new and innovative way of investing through blockchain and DeFi, we can connect issuers of securities to a wider pool of retail investors, thereby offering investors a wider range of quality financial and investment products. We believe that a “regulated DeFi” ecosystem like this creates mutual benefit and opportunities that reward all parties involved.

Singapore is the ideal location to showcase and evolve such financial innovation and transformation. In our submission for the Monetary Authority of Singapore’s (MAS) Global CBDC Challenge – shortlisted with 14 other finalists from a field of over 300 candidates – we demonstrated the interoperability of RDOS with various central bank digital currencies (CBDCs) and stablecoins.

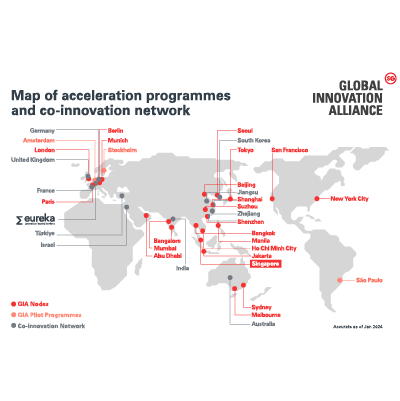

We are also leveraging Singapore’s position as a fintech hub to expand our reach. Last year, we secured partnerships with the Hong Kong Monetary Authority (HKMA) and the Bank of International Settlements (BIS) for Project Genesis, an initiative to create tokenised green bonds for retail investors. Within the region, we are also working with partners in Thailand, South Korea and the Philippines to bring RDOS to other markets.

Lowering the barriers to prime investments

Traditionally, institutional investors and high-net-worth individuals have exclusive access to quality investments – such as private equity, hedge funds or bonds with a minimum investment of $200,000 – which are effectively out-of-reach for retail investors. This has created an ecosystem of fintechs on a mission to make such investment options available to all investors, increasing financial inclusion.

This too was our objective when we established operations for the InterOpera group in Singapore – which includes the Shareable Asset mobile app, a digital investment platform for retail and other qualified investors to access quality investments in an affordable and secure manner.

Utilising RDOS, investment interest can be “subdivided” into smaller portions (which remain custodised), allowing our investors to buy a small portion (i.e. an odd lot) of the underlying investment.

Through this process, we are creating a means of offering “digital custody” of investment interest. This is a gamechanger because it allows the non-traditional investing class (i.e. retail investors) equitable access to quality investments or alternative assets like artwork and real estate. Since investors’ transactions are documented on a publicly distributed ledger – as opposed to centralised physical or digital records held by a financial institution – their ownership of our tokens is direct and immutable, giving them greater control over their investments. Furthermore, blockchain technology reduces the number of financial intermediaries, which in turn increases efficiency and lowers costs for retail investors at large.