From a man-made island to a 3,000-ha refining and petrochemical powerhouse, Jurong Island is marking 25 years as a cornerstone of Singapore’s energy and chemicals (E&C) sector.

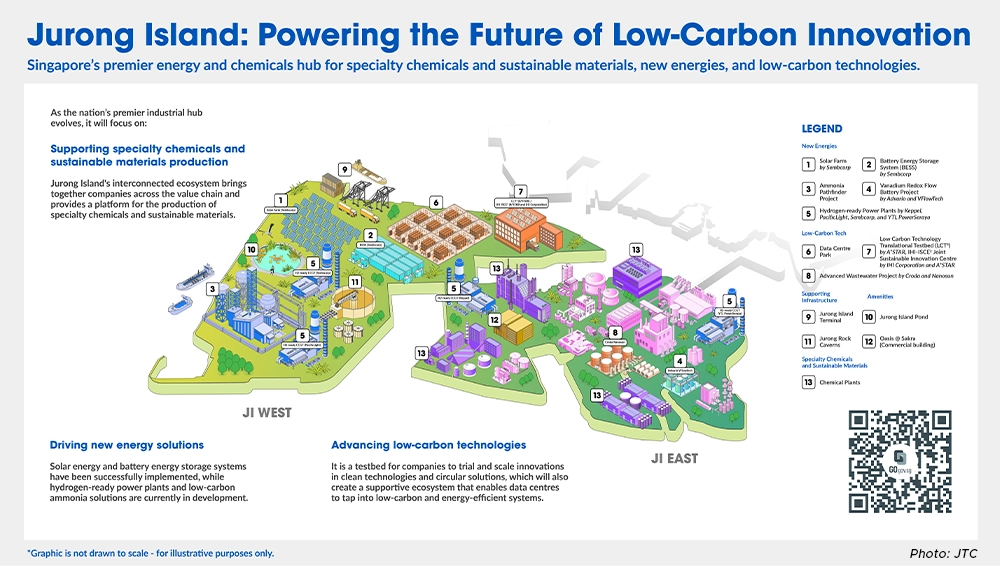

It is home to more than 100 companies including global leaders. To help incumbents stay competitive and attract new investments, Singapore is strengthening Jurong Island’s ecosystem, to focus on low-carbon transformation, specialty chemicals and sustainable materials and being a global testbed for new energies and low carbon technologies.

At the Asia Downstream Summit Fireside Chat on October 30 featuring EDB Executive Vice-President Lim Wey-Len and JTC Chief Executive Jacqueline Poh, Lim highlighted the macro trends that had fuelled Jurong Island’s pivot.

Urbanisation in the region is driving demand for specialty advanced materials in areas like mobility, healthcare, electronics, and consumer goods. Vehicle electrification is also increasing the need for performance polymers, thermal management solutions, and high-reliability industrial platforms, especially in new growth areas like data centres. At the same time, decarbonisation remains a priority for the industry.

“These macro trends are driving a portfolio shift in the E&C industry, as many chemical companies are shifting from commodity molecules towards specialties, where innovation, application development, and proximity to customers drive value,” Lim said.

Supporting incumbents and their transformation

E&C remains a strategic pillar for Singapore’s diversified manufacturing industry, with Jurong Island at its core. The sector contributes about 3 per cent of the country’s gross domestic product (GDP), roughly a quarter of total manufacturing output and employs 27,000 people. In the last three decades, it attracted more than S$50 billion in investments.

Lim emphasised that Singapore’s E&C ecosystem is integrated across the entire value chain, from refining and cracking to petrochemicals and specialty chemicals. This integration spans both mainland Singapore and Jurong Island, with many companies operating across both locations.

They include Neste, which transports hydrogen from Jurong Island to manufacture sustainable aviation fuel on the mainland, before returning the product to the island for storage – all via pipelines.

As a result, Jurong Island has become a highly interlinked industrial hub, with seamless connections between upstream and downstream companies.

EDB continues to support this ecosystem by helping companies upgrade existing infrastructure to produce higher-value, lower-carbon products, and to improve energy efficiency.

“Supporting incumbents is not an afterthought. It is central to Singapore’s industrial strategy,” said Lim.

For example, ExxonMobil has launched its Singapore Resid Upgrade Project, a multi-billion-dollar upgrade that converts low-value streams into higher-margin lube base stocks and distillates.

Denka has shifted from general-purpose polystyrene to specialty-grade styrenics, while Evonik’s SIMEX expansion - now powered by green hydrogen - increased capacity and reduced energy consumption by 6 per cent, demonstrating that growth can co-exist with decarbonisation.

Firms are not left to shoulder transition costs alone. EDB provides co-funding to close viability gaps for credible abatement and efficiency projects, such as through the Resource Efficiency Grant for Emissions (REG(E)).

Since 2021, 35 projects have been supported under the grant, and these are expected to abate over 340,000 tonnes of carbon dioxide (CO2) when completed, equivalent to removing 80,000 cars from Singapore’s roads.

The grant was enhanced in 2024 to lower eligibility thresholds and increase support rates per tonne of carbon abated.

The Singapore government has formalised a partnership with Shell and ExxonMobil – known as the S-Hub consortium – to study the viability of a cross-border carbon capture and storage (CCS) project. This would be a shared, scalable CCS pathway that multiple plants can connect to over time, reducing capture, transport and storage costs per tonne.

When fully developed, the project will be able to capture and store at least 2.5 million tonnes of CO2 annually.

Growing High Potential Sub Sectors

The global chemical industry is facing challenges, with rationalisation underway across Europe and Asia, but specialty chemicals and sustainable materials are a bright spot for growth.

More than 30 new specialty chemical projects have been set up in Singapore since 2021, with the majority on Jurong Island. Companies have noted that being in Singapore allows them proximity to regional customers, spurring co-innovation.

In addition, Singapore’s strong logistics performance – it is top in the World Bank’s 2025 Logistics Performance Index – shortens time to market and allows MNCs to accelerate product qualification.

These factors led to Kuraray setting up its Asia-Pacific Technical Centre in Singapore’s Science Park in September 2025 to complement its ethylene-vinyl alcohol copolymer production facility on Jurong Island, enabling collaborative development with regional customers.

Changing consumer preferences are also giving rise to growing demand for products made from circular or bio-based feedstock, or with superior sustainability benefits.

For instance, Arkema’s PA-11, which is used in medical devices like syringes and catheters, and hydraulic hoses in the automotive and transportation industry, is made entirely from castor oil.

With Southeast Asia projected to generate 56 million tonnes of mismanaged plastic waste annually by 2050, Mura Technology plans to build a 50 kilotonnes per annum advanced recycling facility within the PCS complex on the island. Singapore provides the ideal platform for Mura’s new facility to recycle both local and regional plastic waste into premium, circular feedstocks.

PCS, a key company at the S$5.4 billion Singapore Essential Chemicals Complex on Jurong Island, has also partnered with Neste to replace fossil raw materials with bio-naphtha to enable the production of lower-carbon products like ethylene, propylene, and butadiene. These are essential feedstocks for materials used in daily living, including plastic food packaging, car tyres, athletic shoe soles, gloves, and household appliances.