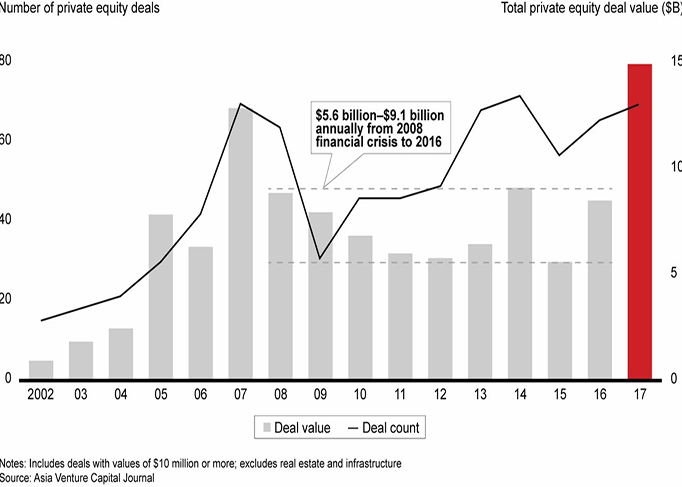

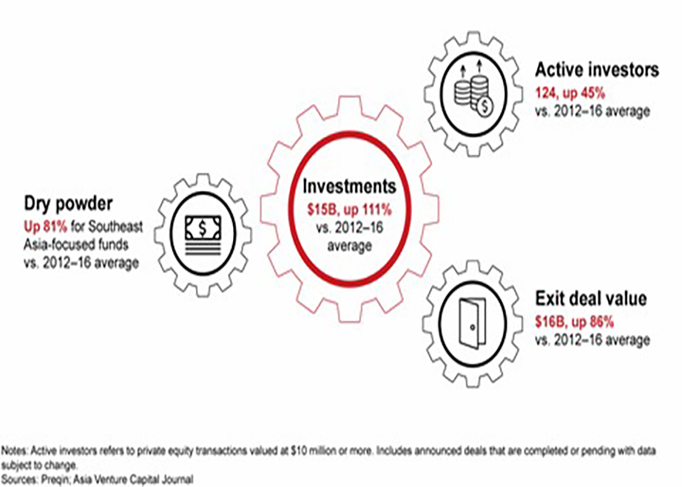

Skilled investors produce strong returns in a changing market by raising their game. They manage risks by increasing the value of their investments and propelling companies to a higher level of growth and performance. In the coming year, some sectors in South-East Asia will face greater pressure than others. Investors targeting healthcare and medtech, for example, already face intense competition.

In our experience, investors who succeed in adding significant value to their companies share a common approach based on four principles.

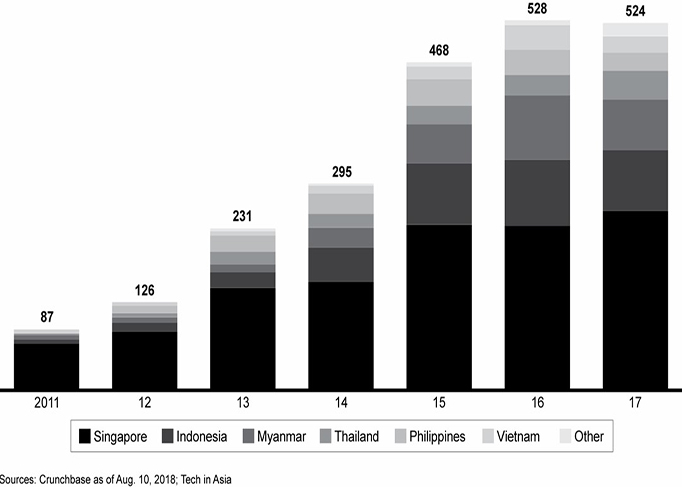

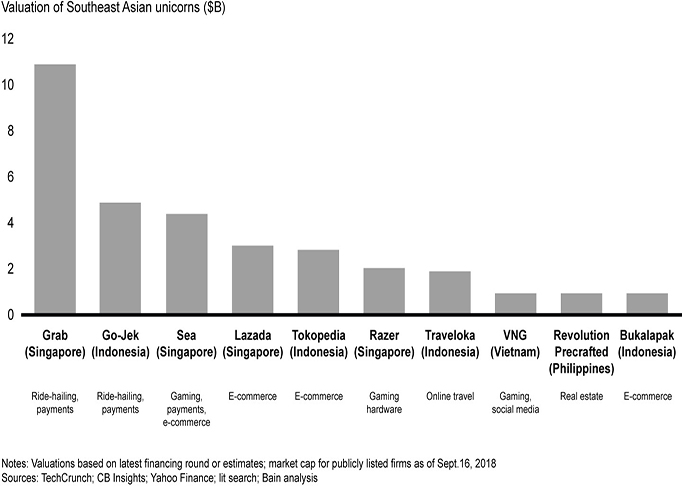

Take an ASEAN perspective when evaluating deals. Smart investors already are making cross-border expansion part of their value-creation plans, as regulatory developments make it increasingly attractive. Companies that diversify across South-East Asia grow faster and reduce the risk of relying on a single economy. They also benefit from the ongoing integration of these markets. South-East Asia’s new cluster of unicorns spotlight the potential for spectacular value creation in the region.

Identify the right talent for the biggest roles. Bain research shows portfolio companies’ leadership is the greatest source of success or failure for value creation in Asia-Pacific investing—and talent is particularly scarce in South-East Asia. However, many investors take an overly positive view of management teams early on. The most successful investors get the right leadership in place to deliver on the value-creation plan.

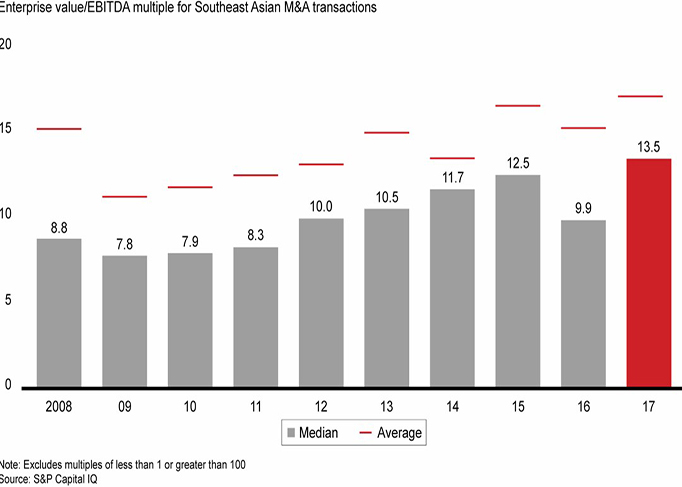

Build commercial excellence to boost organic growth. Accelerating top-line growth lifts profitability and magnifies exit multiples, but it’s hard to get right. Only 24 per cent of general partners say they have met top-line expectations in most of their portfolio companies over the last few years, according to Bain & Company’s 2018 private equity survey. Leading PE firms make sure their portfolio companies build strength in commercial excellence by increasing customer segmentation, upgrading salesforce effectiveness, and revisiting pricing or product portfolio strategy. Those moves help management teams spot organic growth opportunities and generate big payoffs. Bain research shows the median return on investment is 20 per cent to 30 per cent higher when using a commercial acceleration program.

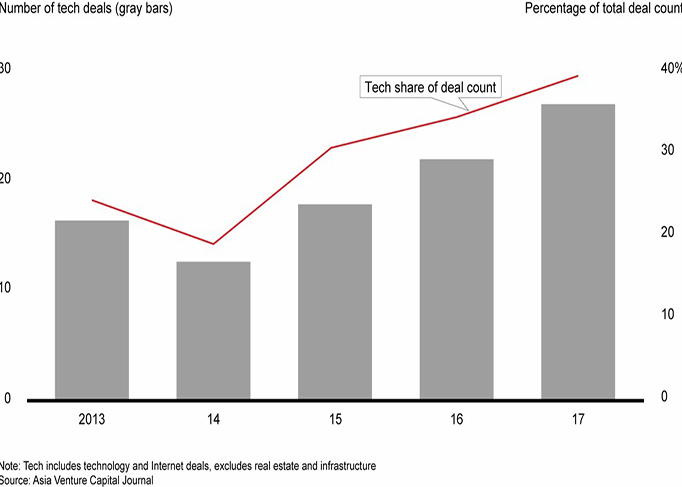

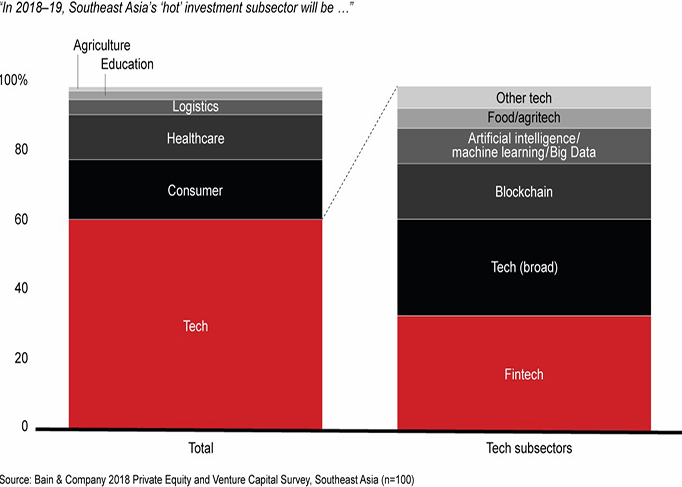

Make the most of digital technologies. Top global investors are helping management teams understand how new technologies are shifting their profit pools. Digital tools can help them take practical steps to improve their strategic position, commercial performance and cash flow. Portfolio companies that embrace digital strategies are better positioned to manage disruption and keep pace with rapidly changing markets. We expect digital disruption in South-East Asian markets to continue moving faster than in Western markets. China overtook the US in total e-commerce sales because it had higher online and smartphone usage and fewer physical stores per capita. Technology giants Tencent and Alibaba are investing heavily in technology startups throughout South-East Asia, betting the same dynamic will play out.

Investing in South-East Asia is taking off, but new challenges will require investors to navigate adroitly. Those who build regional businesses, secure top talent, improve commercial excellence and harness digital technologies will be best positioned to produce the solid returns they’ve long been anticipating

This article is written by Suvir Varma and Alex Boulton. Suvir Varma is a senior advisor with Bain & Company’s Global Private Equity practice, based in Singapore. Alex Boulton is a principal in the firm’s Singapore office.

This article was first published on Bain's Insights on 13 November 2018.