Bespoke offices expertly designed for the generations to come

Family offices allow “oversight and balancing of risk across a family’s entire portfolio”, as opposed to disparate “pockets” of wealth being managed by different private banks, Mr. Rajah explains.

“Professionals at that level, whose interests are aligned with the family’s and not to generating sales or revenue, really help the families manage their risk,” he continues.

To ensure that wealth lasts many generations, professionals like Mr. Rajah and his team at Rajah & Tann assist family offices with family governance and succession planning. These mechanisms not only help to ensure that each line of the family has a voice in the running of the family office, but also allows for the fair distribution and management of assets, ensuring wealth continuity and family unity.

Family offices can also build relationships with Asia’s top universities in the country to oversee the next generations’ needs for education and even train them for family office or business management.

From the report, Mr. D’s* children, after graduating from Singapore’s universities, were able to gain experience managing the family office under the supervision of a trusted team of investment professionals hand-picked by Mr. D himself. His children would also attend education programmes in Singapore hosted by and for family office executives and experts.

This development of next-generation capabilities can be incorporated into family office structures and is supported by the wider family office ecosystem in Singapore. In this way, families can ensure the smooth handover and management of the family office and business for generations to come, at no expense of wealth or family values.

A promising future for family offices in Singapore

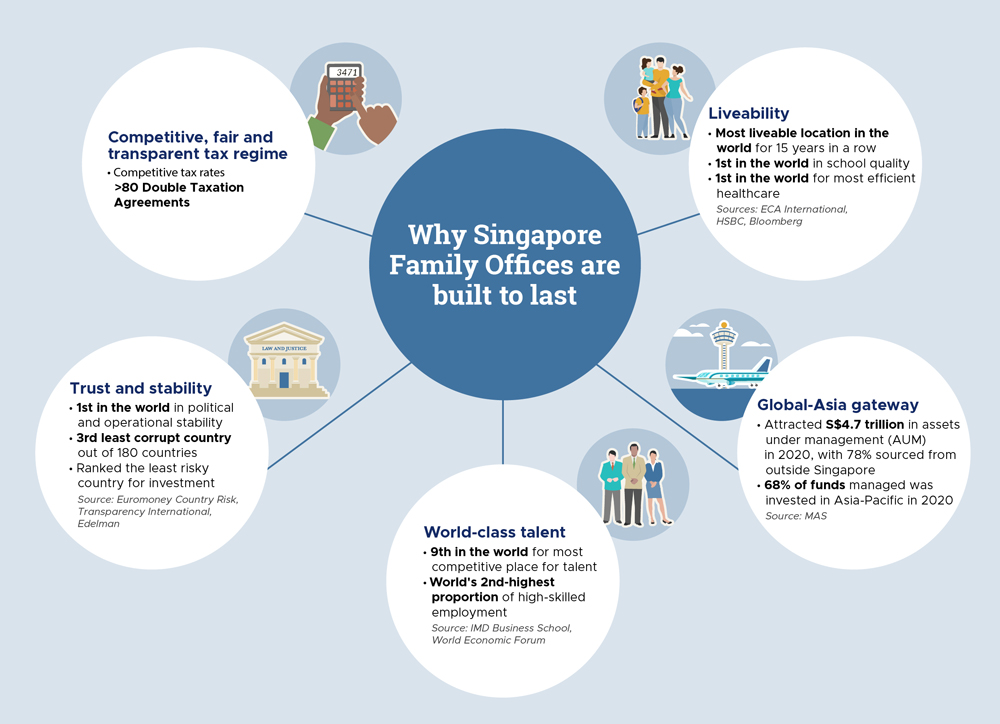

“We have the right framework, the right incentives coupled with substance to really push what family offices can achieve,” Mr. Rajah concludes. As a trusted and stable jurisdiction with strong legal and financial infrastructure, Singapore is well poised in developing global plans for clients with diverse backgrounds and needs.

Mr. Rajah is confident that more families will flock to Singapore to set up family offices here: “That is a key trend that I’ve seen, and I think that will only continue.”

*Note: Mr. C and Mr. D – cited in the article above –have not been identified for privacy reasons.