Singapore's position

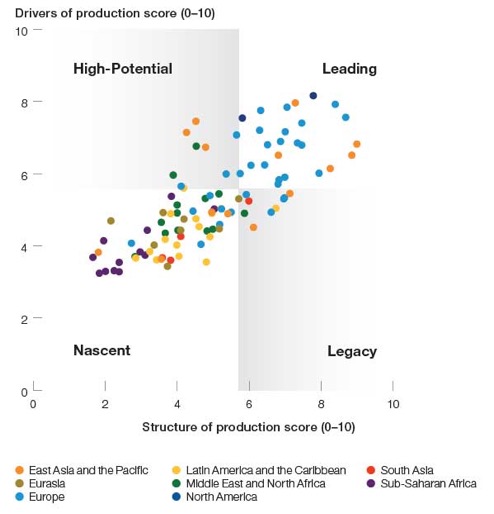

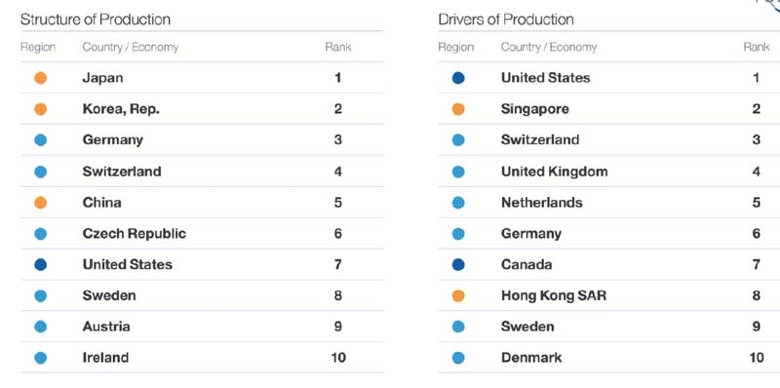

Singapore is among the above mentioned 25 Leading countries. It ranked 11th for the Structure of Production, and 2nd for Drivers of Production. It ranks in the top 20 for economic complexity and performs well across all Drivers of Production, except Sustainable Resources. Within the Sustainable Resources driver, Singapore contributes less emissions than other Leading countries, but has challenges related to baseline water stress and alternative energy sources.

The assessment finds Singapore to be a leader on the Global Trade & Investment driver as one of the most open and trade-friendly countries in the world. The Report highlights Singapore’s strong Institutional Framework and future-oriented approach (the recent launch of the Singapore Smart Industry Readiness Index is mentioned as an example) of the Government as key strengths.

Mr. Lim Kok Kiang, Assistant Managing Director, Singapore Economic Development Board, commented on the report, "Singapore’s strong performance in the Drivers of Production reflects our commitment and early efforts in building an ecosystem to drive the adoption of advanced manufacturing amongst our MNCs and SMEs. The launch of the Singapore Smart Industry Readiness Index, a world-first tool to help industrial companies harness the potential of Industry 4.0, and Hannover Messe staging its first Asia edition in Singapore later this year, will reinforce our efforts. Transformation is a multi-year journey, and more needs to be done. It is important that we continue working closely with companies, trade associations and unions to improve our competitiveness and ensure our workforce is well equipped to support and enable the future of production."

Key general findings

The findings are intended to catalyse multi-stakeholder dialogue to inform the development of modern industrial strategies. The report recommends leaders from both the public and private sectors to work together to address key challenges, build on opportunities and define joint actions at the national, regional and global level.

The Report finds that the Fourth Industrial Revolution will trigger selective reshoring, nearshoring and other structural changes to global value chains. Emerging technologies will change the cost-benefit equation for shifting production activities and, ultimately, impact location attractiveness. All countries must develop unique capabilities to make them attractive production destinations and capitalise on these shifts.