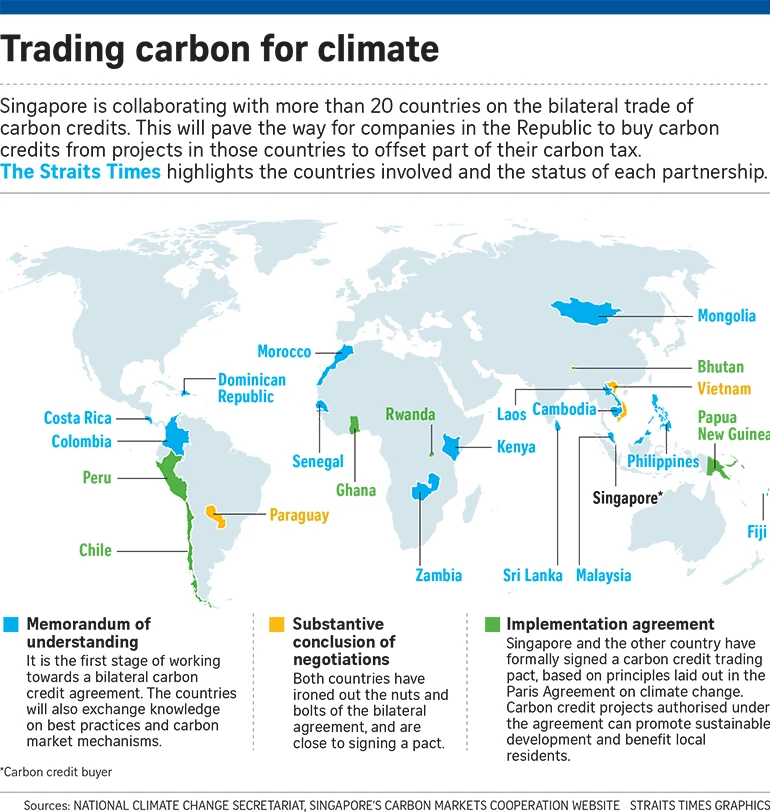

The land locked East African nation of Rwanda has become the latest country to finalise a carbon trading agreement with Singapore – the sixth such pact that the Republic has inked since end-2023.

The implementation agreement was signed on 6 May by Minister for Sustainability and the Environment Grace Fu and Rwanda’s Minister of Environment, Dr Valentine Uwamariya, during her visit to Singapore.

Ms Fu – who is also Minister-in-Charge of Trade Relations – noted that the carbon trading pact adds to Singapore and Rwanda’s “strengthened cooperation in forward-looking areas such as digital economy and FinTech”.

Dr Uwamariya said: “Through this agreement, we aim to promote high-integrity carbon markets, achieve tangible emissions reductions, and support sustainable development for our communities.”

Singapore has also inked implementation agreements with Papua New Guinea, Ghana, Bhutan, Peru, and Chile.

These bilateral pacts will allow Singapore to buy carbon credits to offset some of its greenhouse gas emissions, enabling the country to meet its climate targets under the Paris Agreement. Under the climate pact, countries can buy carbon credits generated in other nations or regions to meet domestic climate targets.