New and emerging technologies will redefine the global business landscape, especially the manufacturing sector - the keystone of Singapore's economic framework.

The speed at which new technologies are permeating every aspect of the world economy makes it an imperative for all countries to modernise their manufacturing base and the services ecosystem that supports the process.

For a trade-dependent economy like Singapore - where manufacturing forms the bulk of its exports and value-added growth - the unprecedented and exponential scale of technological diffusion brings both challenges and opportunities.

The 10-year plan announced earlier this year to boost manufacturing growth by 50 per cent - the same pace as in the previous 10 years - does not sound ambitious enough.

But part of the plan is to focus more on bringing in advanced manufacturing - which includes both new production methods and making new products enabled by innovation - and that initiative may hold the key to addressing the complexities and uncertainties of the present and harnessing opportunities of the future.

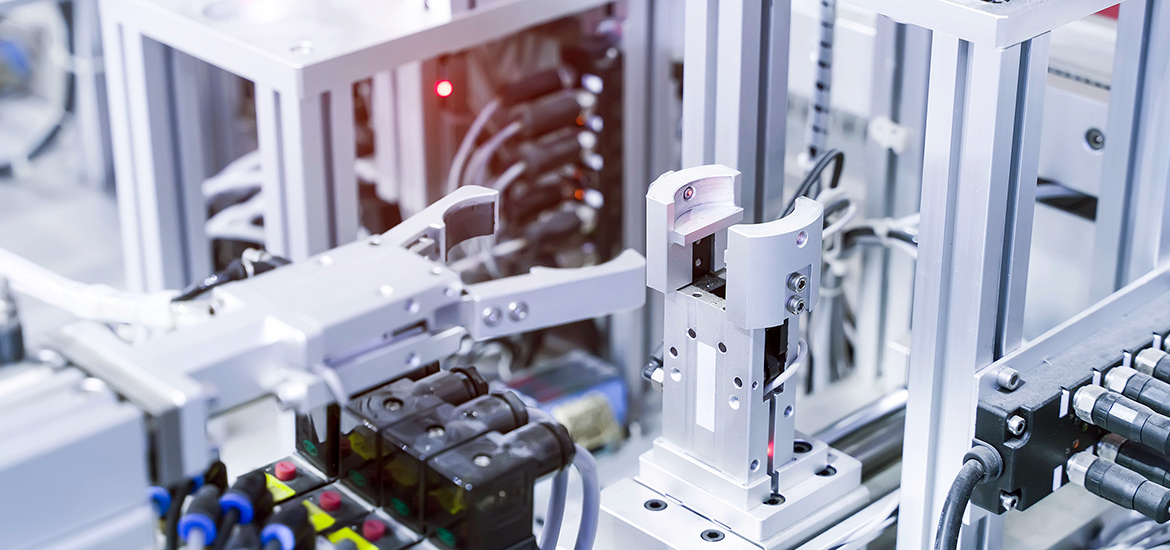

While traditional manufacturing is based on the use of dedicated plant and production lines with little or no flexibility, advanced manufacturing involves versatile production methods that are more efficient, effective and responsive.

It relies on smart digital technologies - such as Internet of Things, artificial intelligence, machine learning and big data analytics - to integrate production and business activities into a seamless, efficient operation.

Some of the advanced manufacturing techniques being used to develop new markets, new technology and new products include additive manufacturing such as 3D printing, powder-bed laser printing systems, fused deposition modelling and other processes that create highly complex assemblies from one continuous material.

Advanced and composite materials - such as high-strength alloys, recyclable plastics, advanced ceramics and glass - along with nanotechnology that produces materials and devices on the scale of atoms and molecules, are creating a whole new line-up of products from microelectronic devices to man-made polymers.

Robotics and automation are already becoming common in industries from automotive to aerospace to consumer goods, and as the understanding of robotics increases, so too does the ability to implement automated systems in more sectors.

Of course, some of these smart technologies and advanced manufacturing processes and products have been around for decades.

According to the International Federation of Robotics, Singapore ranked No. 1 worldwide for robot density - robots installed per 10,000 employees - in the manufacturing industry in 2019.

The idea that a push from the government would help promote the take-up of advanced manufacturing technologies is also not new.

Germany initiated the Industrie 4.0 concept in 2011 - popularly known as the Fourth Industrial Revolution. In 2014, the Manufacturing Industry Innovation 3.0 strategy was introduced as part of South Korea's Creative Economy Initiative, followed by Taiwan's Smart Machinery Promotion Programme in 2016.

China announced its Made-in-China plan in 2015, three years after the administration of US president Barack Obama chartered the National Science and Technology Council's Subcommittee on Advanced Manufacturing, which was responsible for planning and coordinating federal programmes and activities in advanced manufacturing research and development, and developing and updating a quadrennial national strategic plan for advanced manufacturing.

Singapore for years has been pushing digitalisation and innovation through various schemes, such as Go Digital, and government institutions such as the Agency for Science, Technology and Research, for both small and medium-sized enterprises and larger local firms.

The aim of these schemes and institutional support has been to close the technological gaps local companies may have, and enable them to access higher-value business opportunities that fit them into the global supply chains of multinational corporations that are already here or on their way in and plan to speed up their adoption of advanced manufacturing.

So it is neither too late nor too early for Singapore to make a bigger push towards the future of manufacturing.

But more recent developments have added a sense of urgency and make it just the right time for the pivot. Rising labour costs in China, the intensification of United States-China trade and geopolitical tensions, and the focus on diversification of supply chains amid the Covid-19 pandemic have increased attention on South-east Asia's potential as a global manufacturing hub.

Moody's Analytics notes that while South-east Asia will not displace China as the world's factory, its diverse economies are better positioned than any other global region to benefit from the push to cut labour costs and hedge trade and geopolitical risks.

With the highest per capita income in the Asean region, Singapore is too expensive to compete in the low-cost manufacturing segments.

But it is attracting more attention for its higher-end manufacturing ecosystem - such as the electronics and precision engineering segments - and is seen as a node in the specialised supply chains that industries such as pharmaceuticals and aerospace engineering are looking at.

Singapore can scale up its advanced semiconductor manufacturing base to grab part of the next-generation fabrication business which is dominated by the US, Taiwan and South Korea.

China's shift into higher-value manufacturing, including semiconductors and components, has eroded the global market share of producers here, especially for microprocessors, memory chips and other electronic components.

However, Singapore continues to benefit from its status as a major global producer of memory chips and components.

There is evidence of many global corporates near-shoring their production facilities as artificial intelligence, automation and robots close the cost gap with the advantage of producing near the target market.

Still, most multinationals will keep themselves entrenched in Asia - the world's fastest-growing consumer base.

And emerging supply chain solutions help them do that without maintaining a large production facility or inventory in the region.

For instance, aerospace companies can now use a digital module of a particular aircraft part that they can produce when needed at a 3D-printing facility anywhere in the world.

Singapore can become a node in that just-in-case supply chain, backed by its digital infrastructure that is one of the most advanced and developed in Asia.

Last but not the least is the opportunity of developing local champions of innovation.

Given that leading global corporations are more open now than at any time in the past to at least test new technologies and innovative ideas, Singapore can promote local companies to become irreplaceable components of the global value chain of advanced manufacturing.

Singapore's latest unicorn, Nanofilm Technologies International - an advanced materials tech spin-off from Nanyang Technological University - is just one example of a potential innovation champion.

© 2021 Singapore Press Holdings

This article was written by Ovais Subhani from The Straits Times and was legally licensed through the Industry Dive publisher network. Please direct all licensing questions to legal@industrydive.com.