SINGAPORE - Local start-ups could enjoy a record funding year in 2022, thanks to the positive economic outlook and the continued acceleration in demand for digital services amid the pandemic.

Start-up investors told The Straits Times that while there may be some market realignment, given that last year saw a new high in terms of venture capital funding, they expect deal activity to remain robust for companies here and across the region.

Research firm CB Insights noted that start-ups raised US$621 billion (S$838 billion) globally last year.

This year has certainly started with a bang, with some Singapore-based start-ups closing lucrative funding rounds in the first two weeks alone.

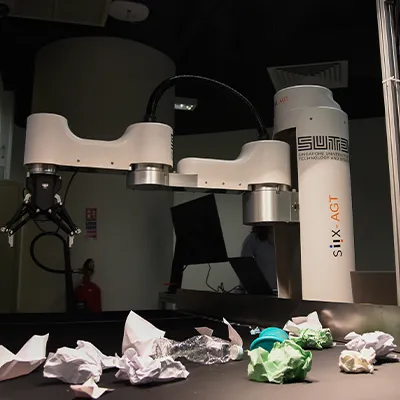

Autonomous technology solutions firm Sesto Robotics raised US$5.7 million from the likes of Enterprise Singapore's investment arm Seeds Capital and VC fund manager Trive. Fintech Brankas said it racked up US$20 million in its Series B round led by Insignia Ventures Partners.

Fellow fintech Crowdo recently closed an $8 million round that will go towards expanding its neobank platform in Singapore and Indonesia and scale its environmental, social and corporate governance financing portfolio.

Mr Hanno Stegmann, managing director and partner at Boston Consulting Group's innovation and venture unit BCG Digital Ventures, is bullish about funding for Singapore's tech ecosystem.

"The overall economic outlook is still strong, the pandemic is continuing to drive change in customer behaviour towards tech, not only in B2C (business to consumer) but also more and more in B2B (business to business)," he said.

"Most importantly, the ecosystem has strong founders with good business ideas, strong investment infrastructure and profits from the good track record and its tailwind record of Singapore-based tech growth stories.”

Golden Gate Ventures managing partner Vinnie Lauria noted how the market need for digital services has been growing exponentially in South-east Asia.

Savvy investors are likely to double down on investments in this region, he said. "Singapore-based start-ups will continue to be a natural choice for overseas investors because of the tremendous ecosystem that has already been established in the last decade, with many high-potential start-ups relocating their bases to Singapore."

Accelerating Asia co-founder and general partner Craig Dixon pointed out that there may be a more measured approach to valuations this year.

There could also be a market realignment from the high valuations seen in the past 12 to 18 months as a result of the international capital influx and general excess liquidity that hit the global financial system last year, he said.

Mr Lauria noted that investors are becoming increasingly discerning and will be looking more closely at each start-up, from its track record to operations and its founders' profiles.

Success in the region is no longer just about market opportunity and has become more complex for investors to navigate, he said.

Sectors such as foodtech, proptech, healthcare, fintech and sustainability are drawing interest from investors.

A spokesman for the Action Community for Entrepreneurship (ACE) said: "Government and large institutions alike are exhibiting a preference for investing with sustainability companies, as more focus is placed on the triple bottom line."

Triple bottom line refers to a sustainability framework that measures a company's success in three areas - profit, people and the planet.

More companies could look to go public this year or early next year as the South-east Asian start-up ecosystem matures, observers said.

Mr Kelvin Tan, chief executive of Origin Capital Management, pointed to PropertyGuru as one Singapore-based company likely to list in the first half of this year.

The real estate company announced its plans last year to go public through a special purpose acquisition company (Spac) merger with Bridgetown 2 Holdings, a blank-cheque company backed by billionaires Richard Li and Peter Thiel.

A PropertyGuru listing could pave the way for the rise of related proptech businesses, such as companies operating in the co-living and facilities management space, Mr Tan said.

Other Singapore-based start-ups tipped to go public in the coming year include online marketplace platform Carousell, logistics firm Ninja Van, cashback rewards firm ShopBack and used-car marketplace Carro.

Mr Lauria said: "There are many start-ups with listing ambitions, but whether they see success when they list boils down to a combination of market opportunity, company track record and long-term vision."

These factors are embodied in the likes of Carousell and Carro, he said.

The ACE spokesman pointed to the Singapore Exchange's Spac framework, which was introduced last year, and said that while there has been strong government action in bringing the first few Spacs on board, it remains to be seen how they will perform in bringing start-ups to the public market.

Mr Stegmann said listings will be more difficult this year than last year and in 2020.

"Investors have now better understood the upsides and downsides of early IPOs (initial public offerings) and in the end, the business still needs to be mature enough, the founding team needs to be professional and the industry and competitive dynamics need to be favourable," he said.

Source: The Straits Times © SPH Media Limited. Permission required for reproduction.