Article was first published on 13 April 2018 and subsequently updated on 20 May 2021

- The city-state’s skilled talent, developed infrastructure, and technological advantages have led many Western MedTech companies to establish their presence here, including Medtronic and Thermo Fisher Scientific.

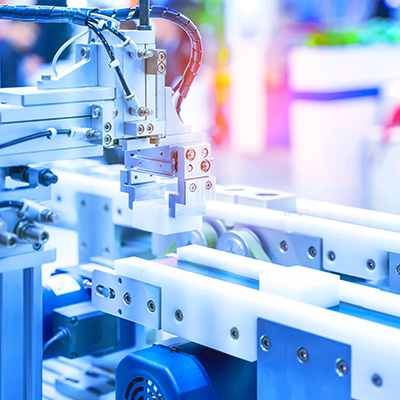

- From contact-lens production lines to medical instruments, Singapore’s MedTech manufacturing output reached over S$15 billion in 2020.

Asia-Pacific’s medical technology (MedTech) sector is immense. By 2023, McKinsey expects it to hit US$137 billion (S$184 billion) in size, growing from an already massive US$95 billion in 2017 to become the second-largest MedTech market in the world.

Numerous factors account for the accelerated growth: An ageing (and massive) population – Asia Pacific is home to more than half the world’s population – with greater access to healthcare, combined with a medical industry that’s undergoing rapid modernisation.

For western MedTech manufacturers, expanding into the Asian market can be daunting as there are significant differences between the medical worlds in Asia and the West. Hospitals and doctors operate differently here than they do in Europe or North America and patients tend to present distinct conditions that require different means of treatment. It may take years for a Western MedTech firm to sufficiently understand the intricacies of this region to succeed.

It’s those differences – and Singapore’s talent, infrastructure, and technological advantages – that have led numerous Western firms to establish its presence in the city-state, which has an outsized influence on the region’s MedTech industry.