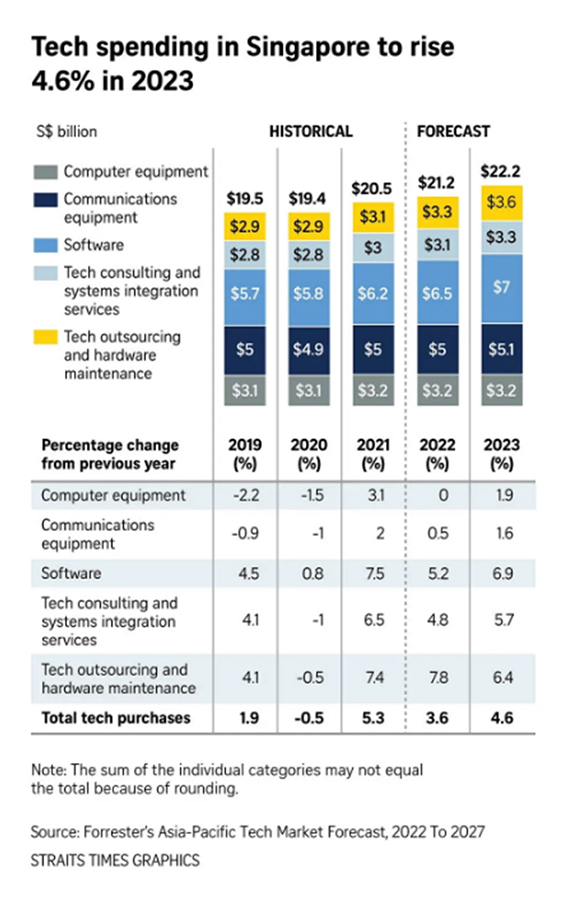

Ms Yean Cheong, Executive Director of tech association SGTech, expects generative AI to bring sweeping change across industries, with companies having to spend on research and development, talent and implementation.

“Over the next two years, we anticipate that tech spending by the private sector will continue to grow,” she said.

In tandem, firms will put money into cloud computing and cyber security in areas such as security solutions, trust audits, certification and accreditation, and employee training, she added.

Tech professional Toh Keng Hoe believes the rise in private sector tech spending in the next two years will be significant.

AI, cyber security and cloud “not only offer businesses greater efficiency, cost savings and competitive advantage but are now also necessary and crucial in the survival of a business”, said Mr Toh, who is President of the AI and Robotics Chapter in the Singapore Computer Society.

Conversely, the Government will spend $3.3 billion on information and communications technology (ICT) in 2023, down from $3.8 billion in each of the last two fiscal years.

It said past efforts to tender in bulk and modernise its back-end ICT infrastructure through the cloud have resulted in cost savings.

The smaller budget is not surprising, said Mr Toh.

“It could signal a successful transition phase where initial investments in infrastructure in the earlier years are now giving way to optimisation and maintenance with significant savings. It could also be a correction due to large Covid-19 spending.”

IBM Singapore general manager Colin Tan said that while bigger expenditures may not necessarily translate to economic growth, spending projections signal the scale and scope of the ICT focus areas that companies and governments are investing in.

Singapore’s industry relied on trade, manufacturing and agriculture when IBM set up its foothold here in the 1950s, he said. “The early investments in technology and innovation paved the way for Singapore’s growth.”

Today, the Asia-Pacific region offers the smallest but fastest-growing market by revenue for many of the world’s biggest United States-based tech companies.

Forrester forecast analyst Himank Joshi said: “The Asia-Pacific’s... tech spending as a percentage of gross domestic product lags in comparison to Western countries, indicating substantial room for boosting tech investments in the region.”