The fast-expanding start-up economy here is becoming more enriched.

While a host of venture capital firms have flocked to the country to invest, some multinationals are also pitching in, boosting the chances of finding the next unicorn.

It is well understood that start-ups don't usually develop into successful enterprises on their own. They need an ecosystem of investors and business partners to provide funding and expertise to turn innovative ideas into commercially viable products for an addressable market.

While start-ups are as old as innovation itself, Silicon Valley mainstreamed the idea of creating an enterprise from scratch by getting these fledgling firms fully funded.

In the 1970s, when innovation became synonymous with technology, the San Francisco Bay Area allowed tech entrepreneurs to rub shoulders with equally innovative investors such as venture capital firms that not only provided funding but also marketing know-how and other enterprise expertise.

The Valley is still the world's top start-up accelerator ecosystem, though its grip on tech talent has started to wane in recent years.

Skyrocketing property prices alone have become a major hindrance to cash-strapped start-ups unable to pay salaries that cover the cost of living in the area.

Then came the Covid-19 pandemic, which not only boosted tech adoption worldwide but also removed the physical constraints of living near the office as work-from-home arrangements became the default.

Valley talent started to disperse around the globe to other start-up ecosystems.

The Global Startup Ecosystem report last year counted 100 emerging ecosystems - including Singapore - that were collectively valued at US$540 billion (S$727 billion), up 55 per cent from 2020.

The jump took the ecosystem value of the global start-up economy to an astounding US$3.8 trillion last year, with 90 of the emerging ecosystems now boasting at least one unicorn - a private start-up valued at over US$1 billion, the report noted.

Policymakers worldwide can see the benefits and are increasingly focusing on entrepreneurs and accelerators - incubators that can boost the possibility of finding the next unicorn.

The accelerator ecosystem is also broadening out beyond financial institutions to universities, research centres and, more recently, large multinationals that are keen to act as incubators for start-ups in the hope of finding innovative solutions for their businesses.

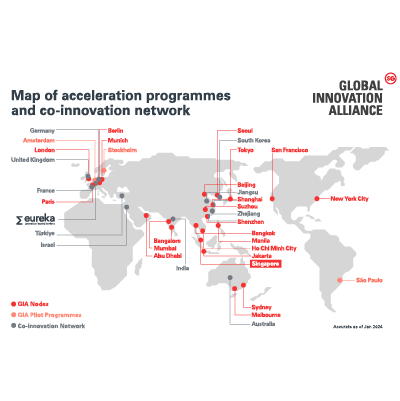

For instance, Royal Dutch Shell and Oracle Corp have been running start-up accelerator programmes here for several years, in part aided by government initiatives and incentives such as the Open Innovation Network and the Global Innovation Alliance.

Mr Jason Williamson, vice-president and global head of Oracle for start-ups, said the company has been running its programme virtually since 2019.

"Since we pivoted to fully virtual in July of 2019, we have had more than 500 start-ups graduate. We had an 89 per cent increase in enrolment last year," he told The Straits Times.

Enrolment in the Asia-Pacific region, including Japan, grew by 130 per cent over the past 12 months, he added.

Mr Williamson said a fully virtual programme has allowed Oracle to help more start-ups, regardless of their location.

Shell's initiative - Shell StartUp Engine - started in 2017 and now operates in Britain, France, Singapore, the Netherlands and India with plans to add more countries.