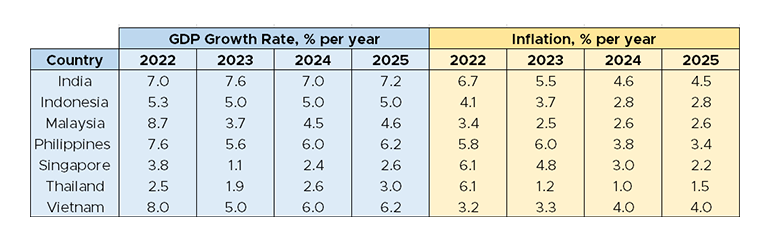

The Asian Development Bank's (ADB) annual outlook report for 2024 paints a promising picture for developing Asia, forecasting healthy growth of 4.9 per cent (Pg 3). Key drivers include stronger domestic demand, expanding tourism revenues, and projections of moderating inflation. Inflation in developing Asia is projected to fall from 3.3 per cent in 2023 to 3.2 per cent in 2024.

While risks persist, such as geopolitical tensions and shipping disruptions, South and Southeast Asia shine as bright spots for growth. India is expected to remain a major growth engine within Asia, while China’s growth is expected to moderate to 4.8 per cent in 2024 amid continued property sector weakness.

Here are a few highlights:

1. Domestic demand is driving growth momentum in developing Asia

Consumption remained strong in the second half of 2023 as consumer confidence improved (Pg 4). Investment has remained resilient with strengthening activity in India, Indonesia and Hong Kong.

However, there are variances across the region – for example industrial production in Malaysia, the Philippines and Vietnam saw modest growth but output in Thailand declined throughout the year.

South Asia remains the fastest growing subregion given the improvement in domestic demand. This growth will be led by services with manufacturing playing a supporting role.