Temasek-owned investment firm GenZero has launched its inaugural whitepaper to address common “misconceptions” around carbon markets and highlight ways to drive climate mitigation at scale.

Launched at the COP28 Singapore Pavilion in Dubai, the “Carbon Markets 2.0 — Addressing Pain Points, Scaling Impact” whitepaper comes at a “critical inflection point” for carbon markets, says GenZero on Dec 2.

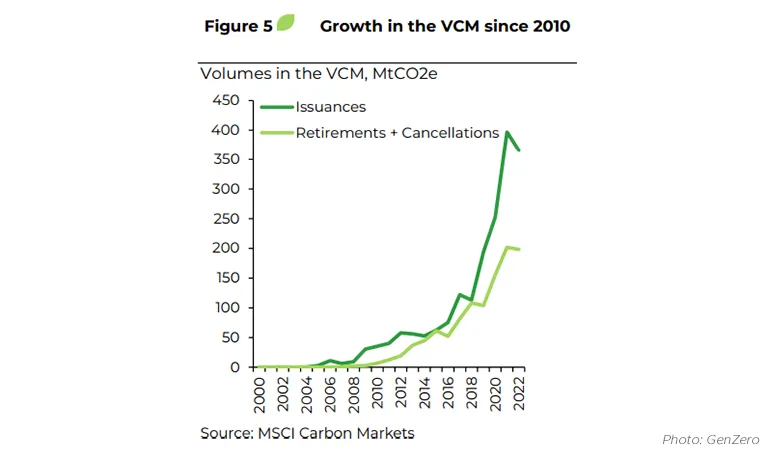

“After a rapid phase of growth in recent years, the carbon market has been buffeted by macroeconomic conditions and heightened scrutiny and is experiencing multiple headwinds,” says the company, which launched in June 2022 with $5 billion from Temasek. “Questions around the integrity of the carbon markets, especially in terms of the quality of carbon credits and their legitimate use as part of corporate decarbonisation efforts, have also emerged.”

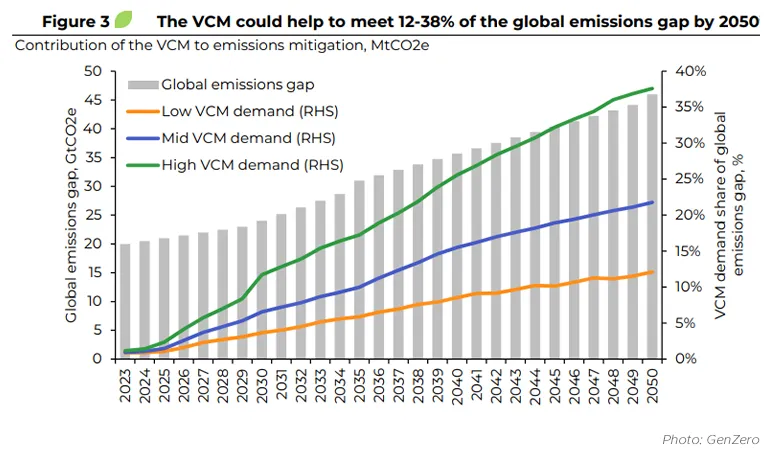

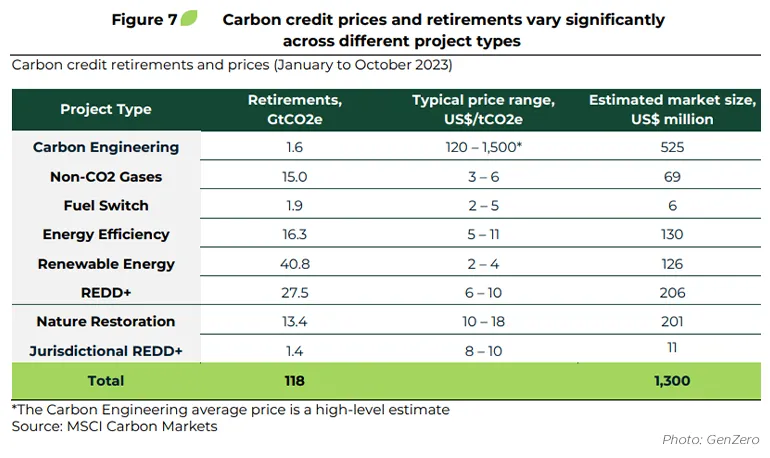

The 30-page report explores the state of the carbon markets today, along with obstacles from both the demand and supply sides. GenZero also offers eight recommendations to “unleash the full potential of carbon markets”, including refining carbon credit taxonomies and incentivising corporate participation.