- Online growth will be off the charts

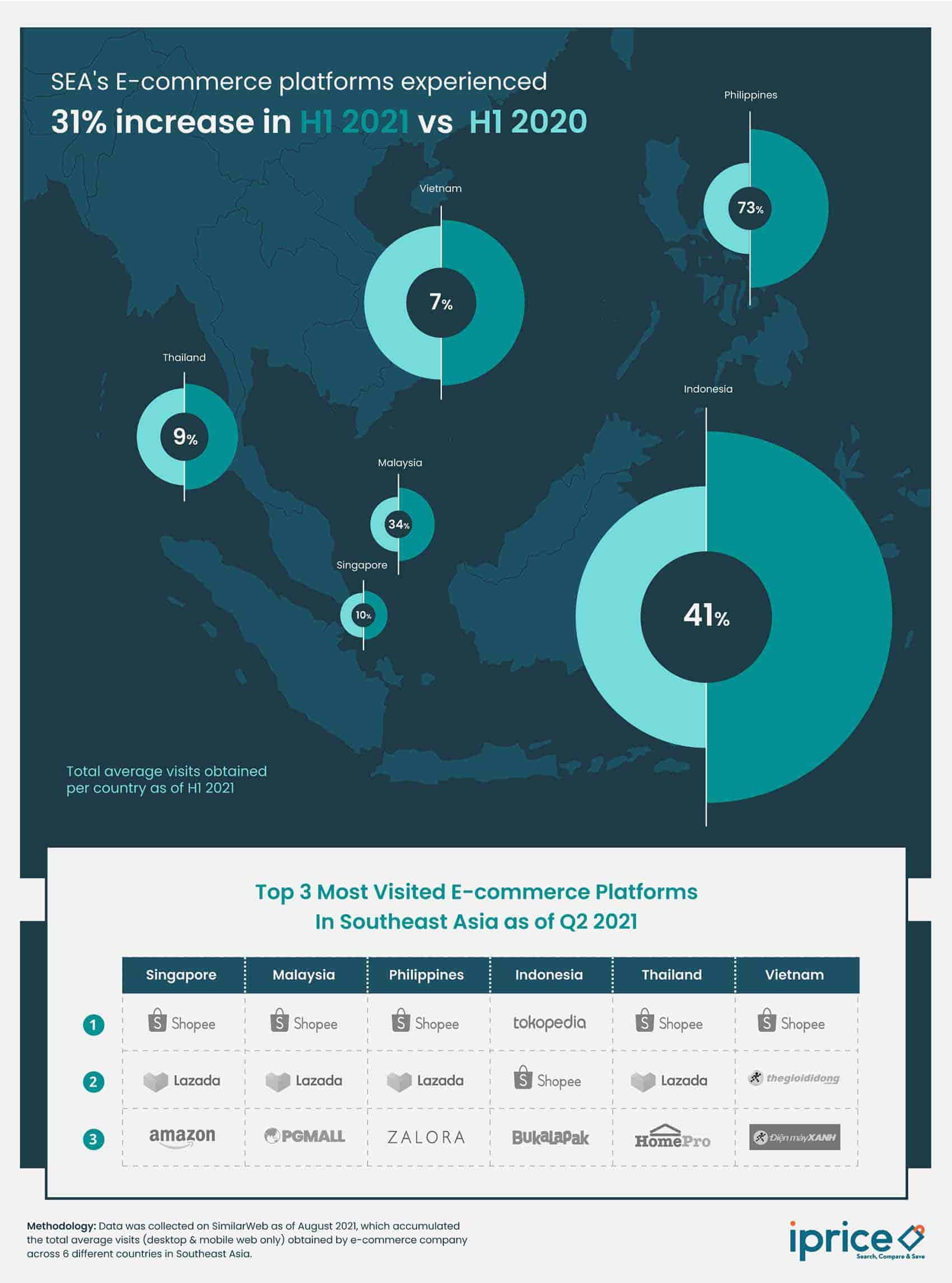

The pandemic-induced digital shift is enhancing online consumption even more than last year. Data shows that the overall web visits of online shopping platforms across Southeast Asian countries remained positive in the 1H 2021.

With more than an average of 4 million web visits from January to June in 2021, the number has increased by 31% compared to the same period in 2020.

With more than an average of 4 million web visits from January to June in 2021, the number has increased by 31% compared to the same period in 2020.

The top two Singapore-based companies, Shopee & Lazada, experienced an increase of web visits by 56% and 10% in 1H 2021 compared to the same period last year.

The surge was probably driven by its constant marketing initiatives to supply value-driven shoppers during the new norm with flash sales, Ramadhan sales, 6.6 sales, and others.

In 2020, iPrice Group saw that the overall web visits grew at 26% from 1H to 2H 2020 across all 6 countries. As such, the company forecasts that the total average web visits will grow even more for the remainder of 2021.

Therefore, online marketplaces will potentially receive an additional average of 690 thousand visitors or more across the region, given that there are many upcoming year-end sales.

- Influencers will continue to drive success to online sales

From footballers to Korean artists as brand ambassadors, along with recent partnerships with Jackie Chan and Hyun Bin, Shopee & Lazada sparked consumer hype as we’re entering the year-end shopping sales.

iPrice Group tracked the social sentiments of the latest 9.9 campaigns. Using this data, the study uncovers which campaign is the most successful.

Jackie Chan’s endorsement has the highest engagement per article. The campaign collaboration with Chan for 9.9 sales has over 59 articles published online while there were 53 articles written about Hyun Bin’s endorsement.

However, the number of articles doesn’t draw a full conclusion. Hence, the study also investigates consumers’ reactions towards these partnerships. Who seems to be the more loved brand ambassador?

Observing the 3.8k social reactions that were recorded, Hyun Bin has the highest number of “love” reactions (79%), along with 19% “haha” reactions, and 2% "wow” reactions from its partnership with the giant e-commerce company, Lazada.

Similar success was seen with the kung fu legend’s collaboration. Jackie Chan’s endorsement was received with 62% “love” reactions, 21% “haha” reactions, and 17% “wow” reactions. It looks like the social sentiments towards these two ambassadors have been positively received by people, according to the data.

It’s clear to see that influencers play an important role in driving excitement for the upcoming sales period. Thus, key e-commerce companies have enough incentive to involve influencers in their campaigns. But does this mean that they will increase the amount of consumer spending during year-end sales?

- Steady increase of consumer spending year-over-year

Given the uncertain COVID infection rates, consumers will continue to stay at home, and consequently forego holiday travels and family get-togethers.

More time spent at home means more opportunities for online shopping. iPrice foresees that Southeast Asian consumers would probably spend an average of USD40 on e-commerce by the end of the year.

The prediction is made by examining the average consumer spending across online marketplaces in the 1H 2020 and 1H 2019. iPrice found that there was an increase of 26% in average consumer spending in 2020, when consumers spent about USD32.

Most purchases will be directed towards the categories of sports and outdoor, home improvements, and electronics.

Lastly, even if consumer spending won’t increase as predicted, online retailers can still expect far more online web visits to their platforms this year.

This article was originally published by iPrice Group.