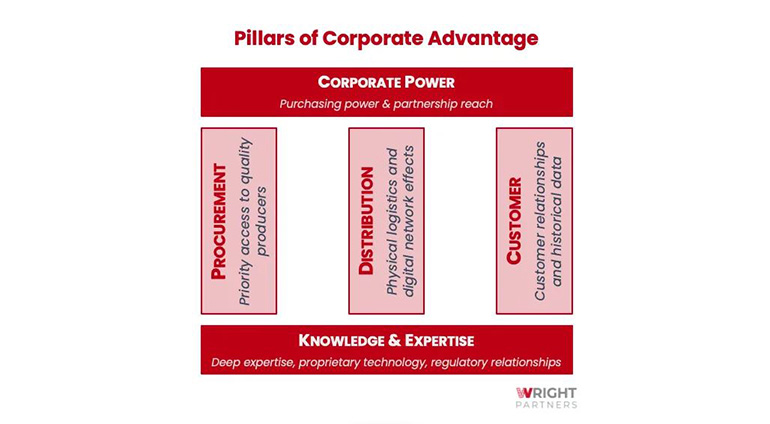

Procurement

Similar to a company’s distribution networks, its supply chain and procurement process can provide a boost to a new venture that most start-ups would struggle to access. However, the supply chain can also be a target for innovation that not only leverages the corporate parent but also returns substantial performance improvements.

Traditional start-ups often focus on tailoring their product to the customer long before thinking about suppliers and pricing. Yet, according to research, 80 per cent of product lifecycle costs are determined during the early design stages. Given at least 15 per cent of venture failures are driven by pricing and cost issues, getting the supply chain and procurement right, early-on, is critical. This is where a corporate with strong relationships to qualified, reliable suppliers can be a real asset to its new venture.

A potentially more powerful asset is the mutual benefit a corporate and its venture get when partnering to innovate within the supply chain. An effective procurement team will know the more innovative suppliers and the challenges that have the most systemic impact. By leveraging these relationships, a corporate can provide its venture with a concrete advantage while improving results for the business. In fact, companies that collaborate closely with their suppliers and drive innovation in their supply chain outperform their peers with nearly 2x growth.

Wright Spotlight

Two of our ventures highlight the advantage focusing on supply chain can provide:

An agricultural processing and trading company wanted to support the small-holder farmers that were its suppliers. It was able to connect the venture with key players and provide insights that helped the venture build a digital marketplace and raise $35MM in their Series A.

A coalition of poultry related family offices wanted to drive innovation along the entire supply starting with empowering the farmers that were their suppliers. By providing insights and key relationships, the coalition helped the venture introduce new technology to the farmers and score $14MM in Series A funding.

Knowledge and Capabilities

This can be the most difficult but most effective of unfair advantages to tap into. Companies that have expertise, technology and legal capabilities that they are willing to leverage and share with their ventures can give them a huge advantage. A strong start-up generally has at least a few founding members steeped in the business they are trying to disrupt. However, corporates often have access to a breadth and depth of experience that start-ups cannot rival. Take, for instance, Coca-Cola’s work with Project Last Mile, a vaccine distribution initiative. Although Coke’s distribution network isn’t suitable for vaccines, their deep knowledge of cold-chain allowed them to co-create an incredibly effective vaccine distribution initiative in developing countries that has been used for fighting the Covid-19 pandemic.

Wright Partners had a similar experience with one of our Telco partners that had an interest in education. Although they already had education-focused CSR programs, they wanted to create a venture that could drive more impact in a way that would augment their existing work. By leveraging their data and technology capabilities, we were able to build an EdTech start-up that provides students with low-cost, digital access to high-quality teachers who are supported by robust data analytics.

There are other advantages beyond expertise that corporates can leverage from an IP, technology and even legal perspective. Corporates own substantial portfolios of Intellectual Property that are barely leveraged. They also often build in-house technology solutions that can be repurposed for other uses (Start-ups, like Slack, frequently pivot to success in this way). Thinking creatively about how these assets can be applied to new markets and strategies can give new businesses a significant market advantage. And, despite the challenge of start-ups that are anti-regulatory, having a good relationship with regulators and deep legal knowledge of an industry is still critical for most new innovations.

Corporate Power

Although the old school types of corporate power have been eroded, there are still ways that companies can use their size to support their ventures. One area that corporates often overlook is whether they can be the first anchor client for a new innovation. Securing a major contract with the core business can help to stabilise revenue forecasts, create trust in the industry, and build a sense of stability and momentum with investors. It also has the added benefit of immediately adding value back to the corporate.

Corporates can also leverage their size to create partnerships that small ventures cannot. Having a corporate backer opens doors to conversations that would be difficult for an unknown start-up. Wright Partners has seen this effect with several of our ventures. In one case, a business platform for micro-entrepreneurs was able to secure credit and capital partners because it was backed by a global bank. In another, a HealthTech platform looking to incorporate IoT capabilities was able to engage device manufacturers in partnership conversations early on by leveraging their investor company.

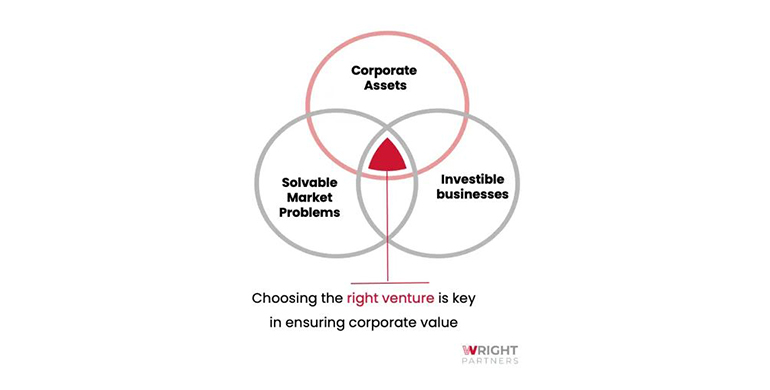

Right to Win with Corporate Venture Building

The experiences mentioned above are a few of many we have had over the last two years, where a company is able to use Corporate Venture Building to embed its unfair advantage into its innovation. We have developed our process specifically to help corporates identify their most powerful corporate assets, align on goals, and test these ideas in market to get real-world proof.