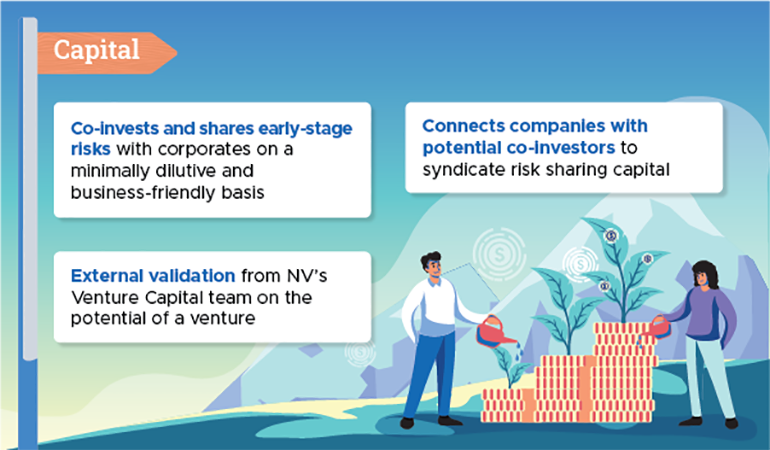

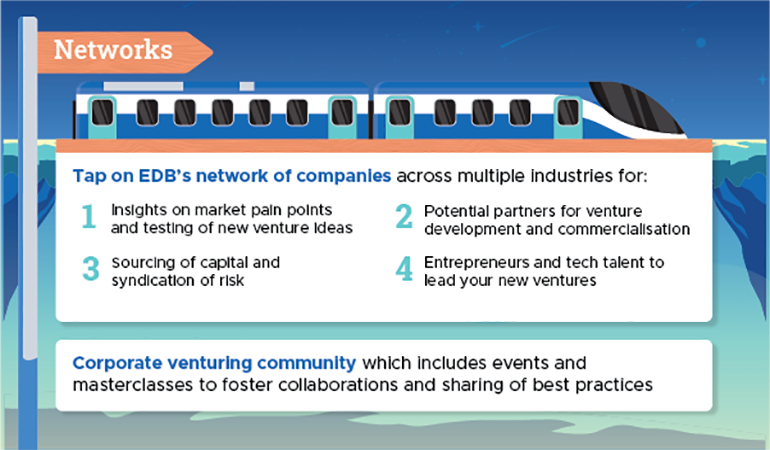

Rapid disruption is putting immense pressure on companies to find new avenues for growth. Executive Vice President, New Ventures and Innovation Heng Tong Choo shares a winning approach for companies to tackle this challenge – corporate venturing. Find out about the strategy and how the New Ventures team – the arm of EDB that catalyses corporate venturing in Singapore – supports businesses in their journey through capital, expertise and networks.

Over the last decade, we’ve seen some of the world’s most established industries upended by technology-driven upstarts. Think Grab in ride hailing, Airbnb in hospitality, and Amazon in retail.

While this “creative destruction” has brought about many modern conveniences, a ticking clock has also been set for many businesses. By 2027, the average age of S&P 500 corporates will fall by 50% to just 12 years.

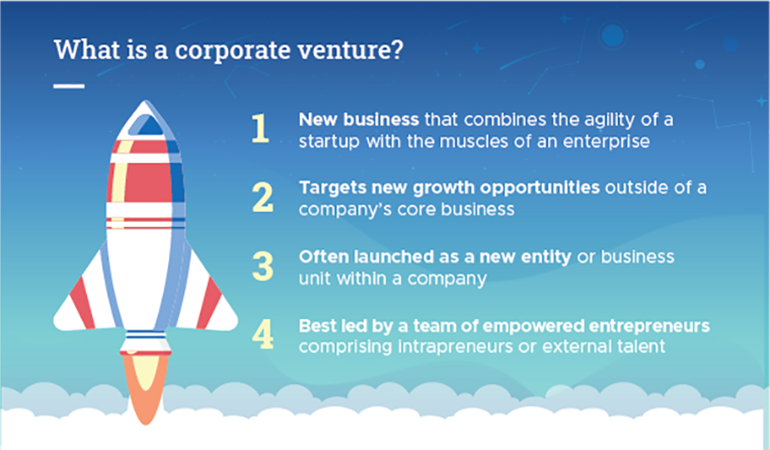

Savvy executives are acting now to secure their business’ future, with 52% of them placing business building as a top-three or higher priority for growth. An increasingly essential avenue for these C-suites is corporate venturing – the endeavour of building new businesses from within one’s company to create new revenue streams beyond one’s core business.

Charting a path to new growth

We’ve seen corporate venturing in action many times. Take for example tech giant Alphabet, which has now successfully created a range of new businesses in Waymo for autonomous vehicles and Verily for health sciences data and research.

In short, think of corporate venturing as a business channelling resources and its advantages to growing its own startup: