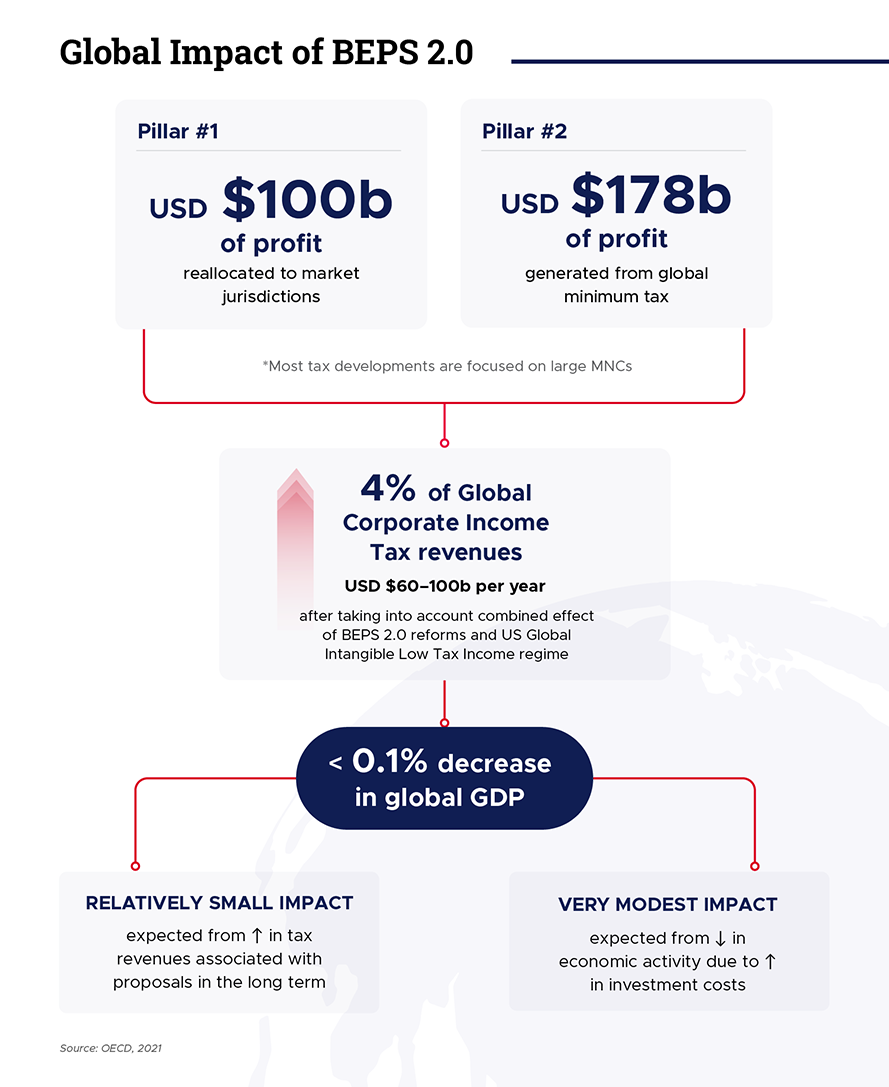

Over the past two years, the Organisation for Economic Co-operation and Development (OECD) has been working on its Base Erosion and Profit Shifting (BEPS) 2.0 initiative. The framework, which aims to address the tax challenges arising from digitalisation, comprises two pillars: Pillar One concerns the allocation of taxing rights between jurisdictions, while Pillar Two seeks to implement a global minimum tax rate.

At a roundtable co-organised by the Singapore Chartered Tax Professionals (SCTP) and Singapore Economic Development Board (EDB), industry experts and business leaders from Baker McKenzie, Deloitte Singapore, Ernst & Young (EY) Singapore, EDB, the Inland Revenue Authority of Singapore (IRAS), KPMG Singapore and PwC Singapore discuss how Singapore will be relevant for companies to seize opportunities and capture new growth in a post-BEPS 2.0 environment.