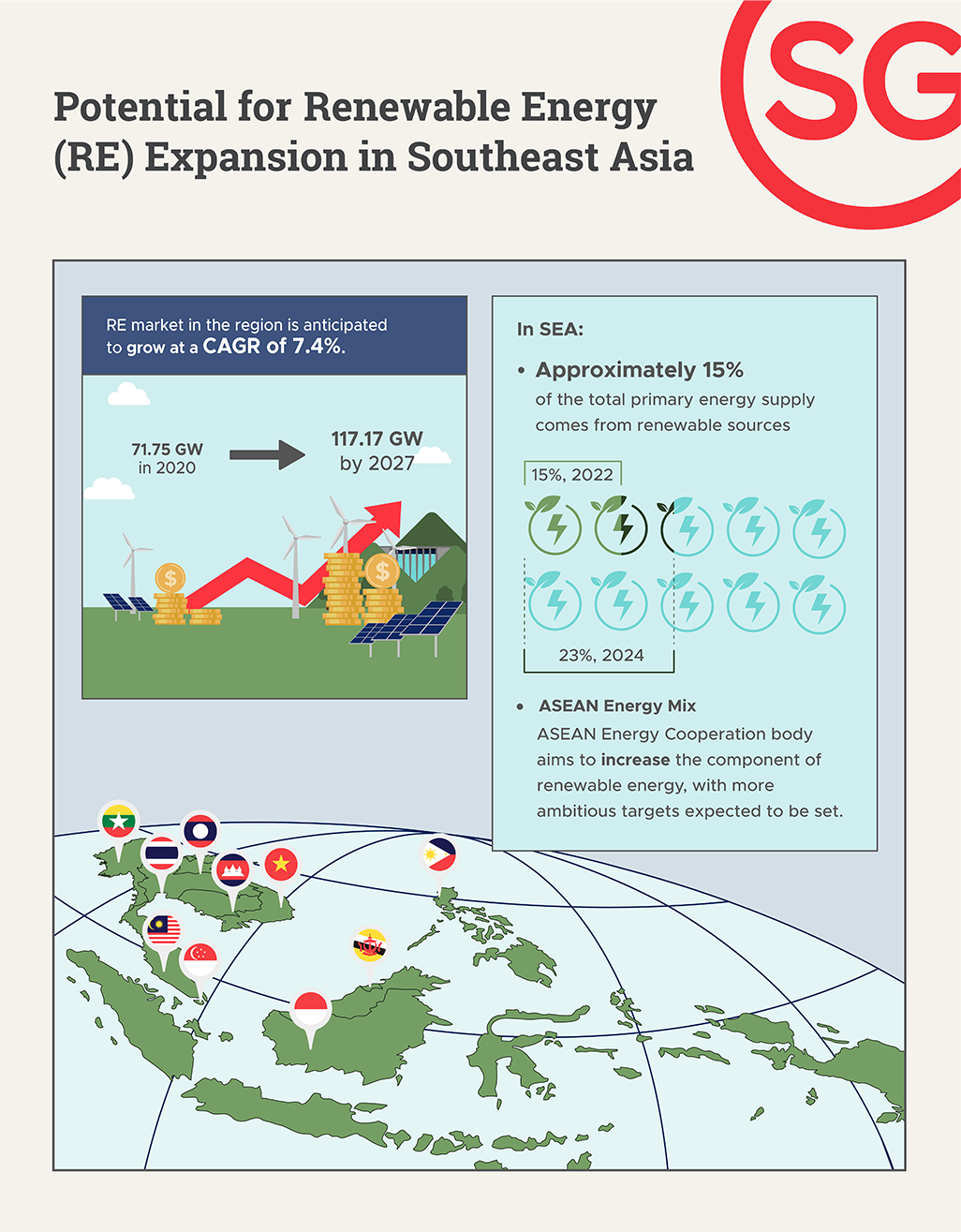

Southeast Asia (SEA) represents an increasingly attractive alternative for renewable energy (RE) companies to expand their operations in a region with growing energy needs. Governments in the region have been ramping up RE generation aggressively - firstly to address rising energy demand, which is at an average growth rate of three per cent annually since 2000, and secondly to honour the commitment to a green transition for a sustainable future.

Renewable investments in APAC are projected to double to US$1.3 trillion by 2030. ALTIOS has conducted research on the rich opportunities in SEA for RE project developers and believes in the market’s growth potential.

To better understand the scale of opportunity in SEA, we take a deep dive into both the solar and wind energy sub-segments.

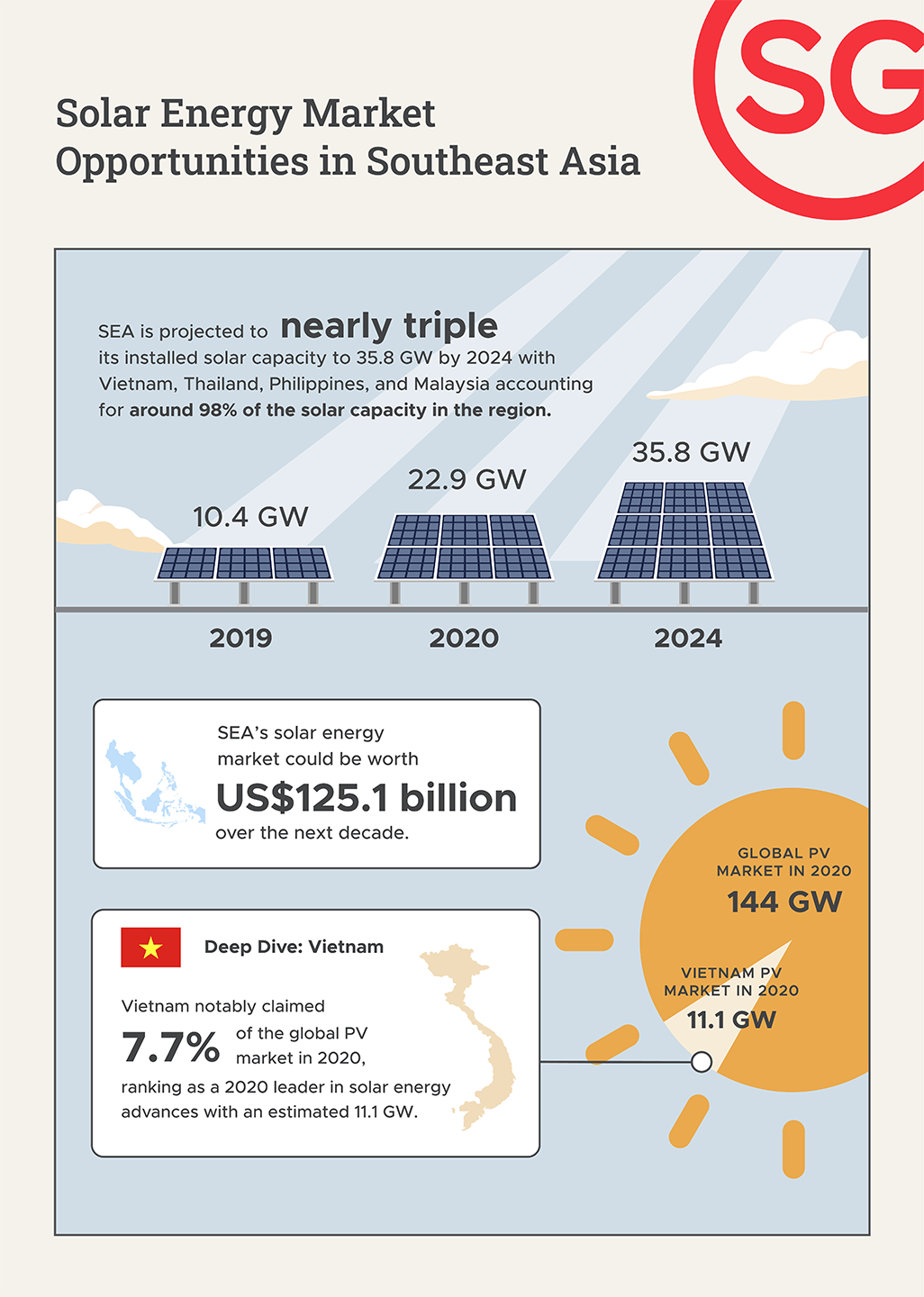

Solar Energy: Vietnam Takes the Lead in Market Growth

A Greenpeace report found that the SEA solar energy market could be worth US$125.1 billion over the next decade, with demand for solar energy only increasing. With increasing installation capacity, significant growth is expected in the coming years, providing ample market opportunities for RE players.

If there is a critical market that solar energy developers can look to for project opportunities, it is Vietnam. As the fastest-growing economy in SEA, the country has surpassed Malaysia and Thailand to reach the largest installed capacity of solar panels. Vietnam has introduced a maximum electricity price ceiling for solar projects, propelling further growth of the utility-scale market and leading to expansive development.

The Vietnamese government has put in place policies and incentives to support solar energy investments. By guaranteeing producers above-market rates, the initiative has enabled five times more installations than initially projected by the government. Other countries are following Vietnam’s lead and implementing conducive policies for investments in solar energy. Solar energy project developers that seize opportunities early will be well placed for success.

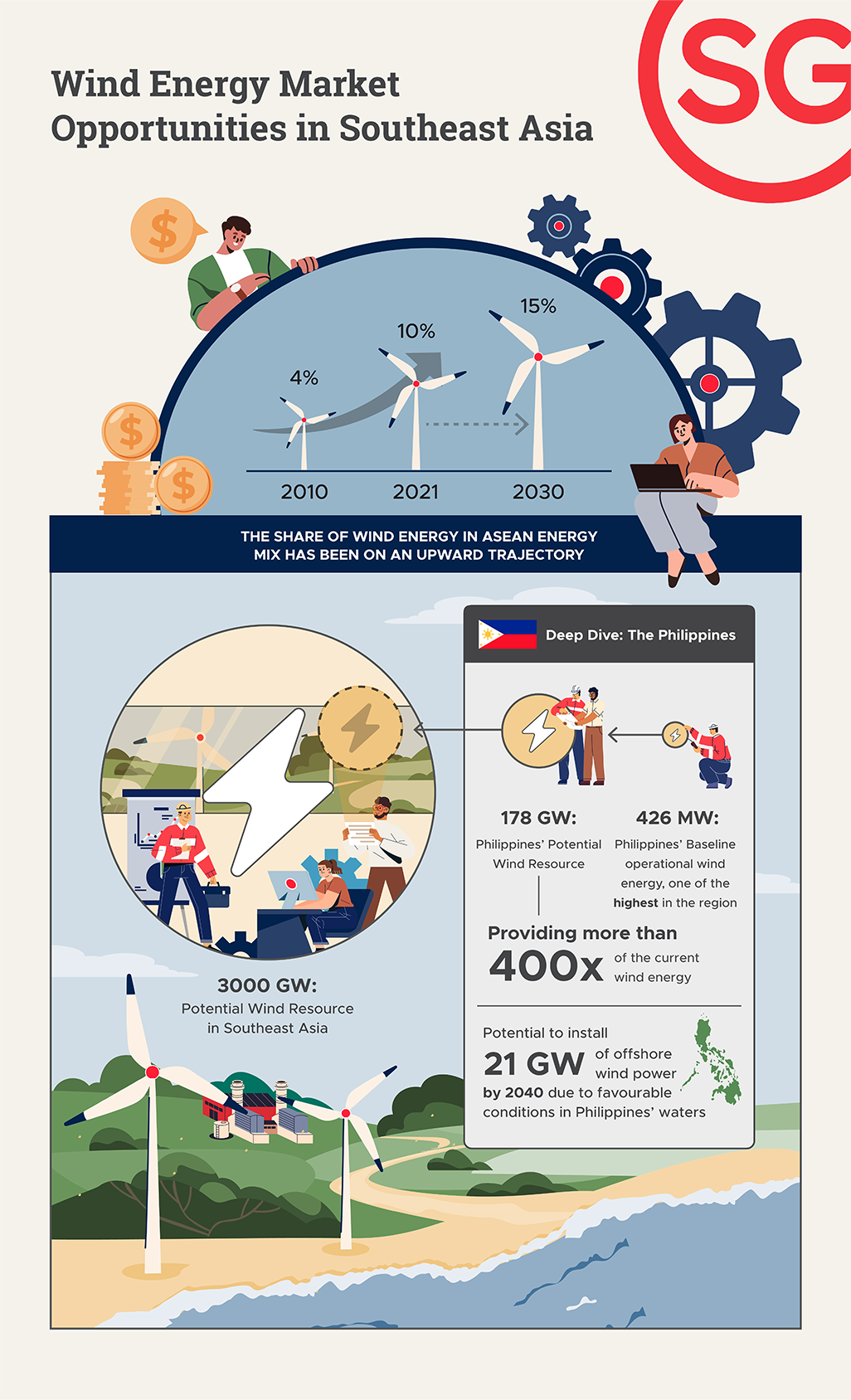

Wind Energy: Opportunities Driving Growth in The Philippines

SEA’s overall capacity for wind power, including existing and future projects, positions it to be a dominant region in wind energy generation. Between 2010 and 2021 alone, the share of wind energy in the ASEAN energy mix grew by a CAGR of 14%.

The Philippines is the second-best investment decision for RE in SEA, where project developers can advance new opportunities. The country’s extensive wind potential is expected to drive the regional market's growth, with more than 178 GW of technical offshore wind potential estimated in the country as compared to 1.27 GW deployed in 2021. Wind energy project developers can make a significant impact by supporting the development of this new capacity.

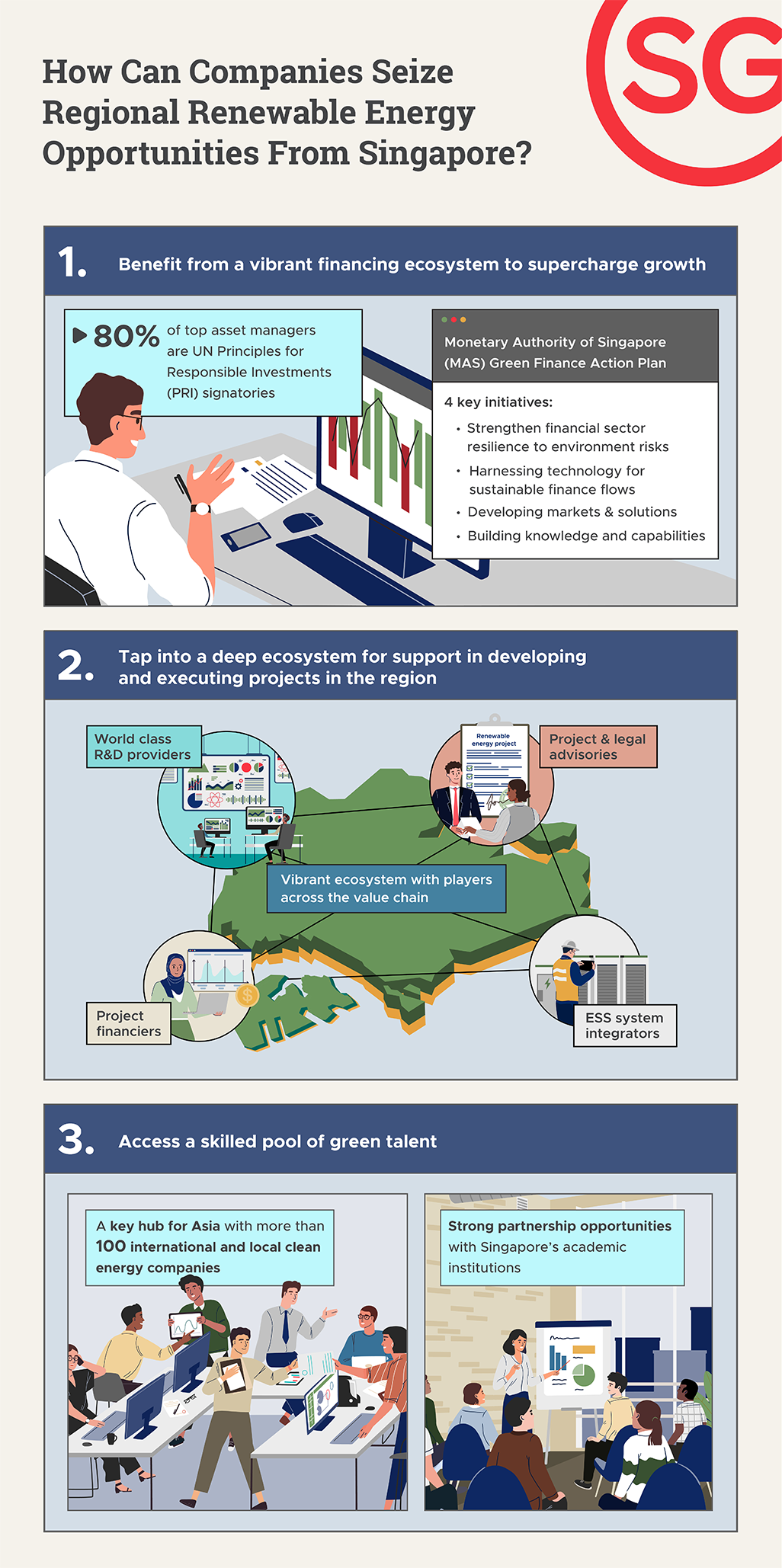

How Can Companies Seize RE Opportunities from Singapore?

Despite the market potential in SEA, foreign businesses looking to capitalise on its growth will need to anticipate some challenges, including language barriers, legal and monetary compliance risks, developing infrastructure and a skilled green talent pool that is still in its early stages. Hence, Singapore plays a critical role in enabling these RE companies to access growth securely and seamlessly in the region.

Robust financing and project ecosystems

In SEA, Singapore is currently leading in RE transition, ranking first in Asia and 21st globally in the World Economic Forum’s Energy Transition Index. As a renowned capital hub, the city-state is home to a vibrant ecosystem of green financing providers who are keen to support impactful RE projects. The Monetary Authority of Singapore is actively promoting a strong green finance ecosystem in Singapore to serve Asia.

Singapore’s connectivity also makes it a reliable regional hub for RE development, innovation, and investments within SEA. Over the years, Singapore has built a credible ecosystem with players across the value chain ranging from R&D providers, legal advisory firms, project financiers and energy storage system integrators.

Access to talent

The city-state has also invested in developing specialised talent for the green economy, especially in clean energy and environmental sciences. For example, the National Trades Union Congress (NTUC) and the Sustainable Energy Association of Singapore (SEAS) conceived a Career Development Plan to attract and groom locals to support the solar energy sector. SEAS also organises Workforce Skills Qualifications (WSQ) solar training courses ranging from project management, design, and installation of PV systems to Internet of Things (IoT)-based energy management. Together with other initiatives, these bolster the country’s position to support the region’s energy transition ambitions.

From climate change to food insecurity, and widening inequality, meet six companies who are driving innovation while balancing profit with purpose from Singapore.

SEA is in the early stages of its transition to a larger share of clean energy in its energy mix, which means that companies have a larger scope to seize opportunities and deliver impact. RE companies will discover that Singapore provides a conducive environment to launch, develop and execute projects in the region.

Arnoul d’Arschot is the Vice President of Advisory & Business Development for Southeast Asia & Oceania in ALTIOS. With more than six years of sustainable growth and project management experience, he has developed complex solutions and strategies to help multi-million-dollar companies exceed profitability and expansion targets.