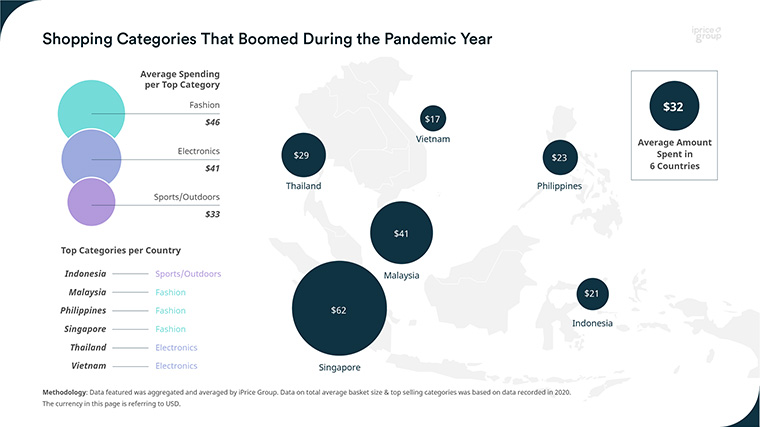

Although fashion and electronics sites saw a slight decrease in web traffic, the average basket size for these categories significantly increased. Sports & outdoor products met the same fate as well.

iPrice Group’s platform found that consumers in Southeast Asia spent an overall average of USD32 per order in 2020, which was 19% higher than 2019’s. Singapore and Malaysia saw the highest average basket size of USD61 and USD41 respectively in 2020.

These unprecedented shifts have presented a sign of digital acceleration in online retail despite the global pandemic that affecting consumers in Southeast Asia.

What Drives Southeast Asians to Install & Uninstall Shopping Apps?

As most people were embracing technology in response to a volatile and uncertain situation, there is a prime opportunity for mobile shopping apps to continuously engage with Southeast Asian consumers.

That said, AppsFlyer (the global leader in mobile attribution & marketing analytics) & iPrice analysed over 12.4 million installs and found that there was a 2% average increase of organic installs on iOS & Android’s shopping applications from January to June.

Among many things that led to users installing shopping applications were lockdown periods and online sales.

For instance, with lockdown measures were imposed in Indonesia, Malaysia, and Singapore, people embarked to install and tried different shopping apps between March until April. This also coincided with various online sales events such as Ramadhan, while people were being trapped indoors.

Meanwhile, the Lunar New Year and Songkran festival also showed a surge of installations in Vietnam and Thailand from January to February.

Major e-commerce companies across the region have also rolled out other marketing campaigns that drew customers through gamified features on the app, free shipping, and discounts. For instance, superstars such as K-pop group Blackpink, actor Lee Min-ho, footballer Cristiano Ronaldo, Singapore’s e-commerce ambassador’s Phua Chu Kang, and others.

The success of organic installs has not gone unnoticed as the study also recognised 6 out of 10 SEA users are still using mobile shopping apps as their primary channel.

However, data reported that there was an increasing rate of uninstallation in 5 countries. The highest average uninstallation was led by Vietnam, Indonesia, Malaysia, Thailand, and Singapore with an increase of 49%, 47%, 41%, 37%, and 36% respectively.

This proves Southeast Asian users are more selective of shopping apps by uninstalling apps they don’t use as the pandemic continues on.

The Covid-19 pandemic will provide further impetus for growth as shopping behaviour will continually shift. It remains imperative for most e-commerce companies to strengthen their relationship with consumers through relevant campaigns.