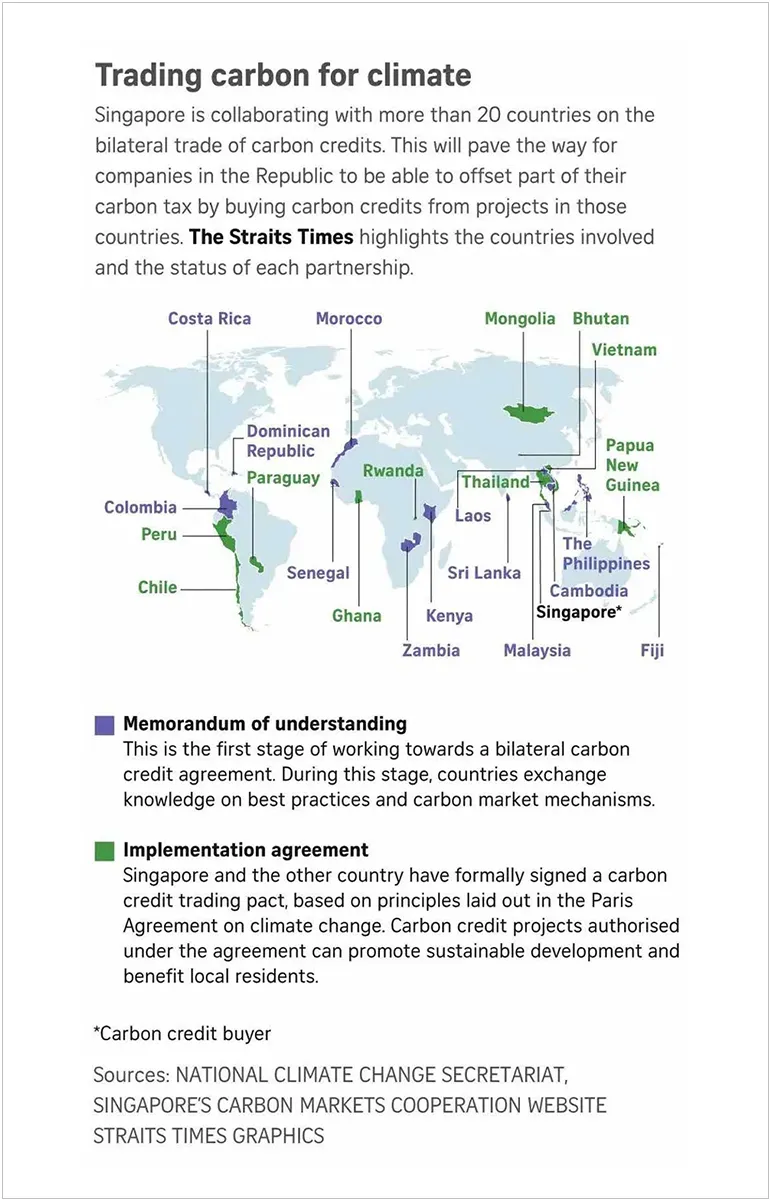

Singapore’s efforts to source for carbon credits from all over the world are paying off, with 10 such deals inked since end-2023.

As of early October, the Republic has signed implementation agreements with Ghana, Papua New Guinea, Chile, Bhutan, Peru, Rwanda, Paraguay, Thailand, Vietnam, and Mongolia.

These agreements pave the way for carbon tax-paying companies in Singapore, as well as the Government, to buy credits from carbon projects in these countries to offset some of the companies’ planet-warming emissions.

But these credits are shaping up to be more than just a way for the Republic or companies here to meet their climate commitments.

Experts say that carbon trading could also help companies save money and boost investments in climate-friendly projects in developing countries. Carbon credits could also become an investible asset class, similar to other commodities.

What are carbon credits?

One carbon credit represents one tonne of carbon dioxide that is either prevented from being released – by saving a forest from the axe, for example – or removed from the atmosphere, such as from a direct air capture plant.

For companies, buying carbon credits is one way to reduce their carbon footprint, in order to meet their voluntary targets, or to fulfil regulatory requirements.

For example, carbon tax-paying companies in Singapore are allowed to buy carbon credits to offset up to 5 per cent of their tax bill.

These credits would come from carbon projects that Singapore has carbon trading deals with.

At the national level, Singapore had earlier estimated that it would use eligible carbon credits to offset about 2.51 million tonnes of emissions a year over this decade to meet its national targets under the Paris Agreement.