The 618 shopping festival – China’s second most important retail event after Singles‘ Day on Nov 11 – recently concluded, in the wake of zero-COVID lockdowns and movement restrictions.

With retail sales shrinking for the third month in May, observers were watching consumer spending, a key driver of China’s economic growth. Response has been lukewarm, with e-commerce platform JD.com recording its slowest sales growth of 10.3 per cent.

Yet one consumer trend remains clear. Chinese consumption continues to shift away from foreign brands and towards domestic upstarts. Euromonitor figures have shown rising market share by domestic cosmetics brands between 2017 and 2021, while foreign brands have stagnated or lost ground.

This shift did not happen as a result of cheaper prices with a trade off in quality – a perception that has traditionally shaped views of “Made in China” products. Chinese consumers are buying less but spending on better quality products, according to a McKinsey study. Anta, China’s largest sports company, is on the cusp of overtaking Adidas as the second most valuable sports company in the world.

Chinese brands have also flourished because of the positive environment for new ventures, due to China’s so-called dual circulation strategy to boost domestic consumption and international exports. Meanwhile, rising nationalistic sentiment in the world’s second largest economy – a side effect of geopolitical tensions – has shaped consumer preferences in a market that has become more mature and discerning.

Cases of international brands that have run afoul of Chinese sensitivities have also helped drive customers towards domestic upstarts.

Still, with consumer spending turning sluggish, Chinese companies are increasingly looking overseas for new pastures.

And Southeast Asia is a natural market for their expansion plans, where about 440 million people are Internet users and consumers largely have no prevailing brand loyalty.

How China’s Homegrown Brands Shot to Fame

China’s rich manufacturing base, well-linked supply chain and mature e-commerce and digital payments ecosystem have created the rise of “direct to consumer”(D2C) brands that sell without going through retailers.

When it comes to cosmetics, homegrown makeup brands are already paving the way for a trend in C-beauty (Chinese beauty) to rival K-beauty (Korean beauty). Perfect Diary was the top colour cosmetics brand during the 2019 Single’s Day event on Alibaba’s Tmall, with sales surpassing international brands like MAC and Estee Lauder.

What have helped D2C brands stay competitive are their short product development cycles and frequent product launches. Perfect Diary launched nearly 1,000 products on its flagship store on Tmall in just one year. Judydoll launches new cosmetic product suites every one to two months.

Brands that ride on explicitly Chinese motifs, cultures and traditions – what some describe as “national trend” (国潮) or “cultural self-confidence” (文化自信) have also made their mark. Florasis, which has drawn on Chinese heritage for its packaging and traditional ingredients such as ginseng for its products, was the bestselling beauty brand on Douyin – the Chinese version of TikTok – last year, according to Bytedance.

A number of homegrown brands have also learnt from overseas experience on branding for a global audience. They put out sophisticated and often globally resonant and savvy messaging: Lingerie and loungewear brand Neiwai’s “No Body is Nobody” campaign that challenged body stereotypes was well received on Chinese social media.

The Competition in Southeast Asia will Heat Up

These factors make Chinese firms well-placed to consider their next moves in the region. And as they do so with the playbooks that have won them success at home, there will be an impact on established brands looking to maintain their competitive edge in a retail environment beset by supply chain woes and soaring inflation.

Businesses should be aware of how Chinese brands are well-equipped to harness their expertise and experience in domestic expansion to disrupt Southeast Asian markets. For example, their savvy use of social networking platforms to engage consumers directly has enabled them to build large and loyal followings.

They use these platforms to drive promotions and campaigns, experiment with gamification and deliver personalized customer experiences. These brands are well-versed and effective in harnessing livestreaming and short videos to attract eyeballs and wallets, techniques which are expected to thrive similarly in Southeast Asia. Such an approach has also allowed them access to data like purchase and repurchase rates, as well as immediate customer feedback and preferences.

Data and feedback also attune them to the desires of consumers and feeds research and development and product innovation. Nio, one of China’s top electric vehicle companies, not only delivers highly customisable cars, but also provides novel battery leasing and battery swapping solutions that enhance the consumer experience. With built-in social media and e-commerce features into its app, the company even incorporates direct feedback from consumers in its product upgrades. Today, its cars outprice even those of Tesla.

Incumbent brands will need to stay agile if they do not want to be displaced in a Southeast Asian market where digital consumption has become a way of life.

More Choice for Consumers

For consumers, the overseas forays of Chinese brands will offer them a greater variety of product categories and front row seats to the latest trends.

Earlier this year, popular ice cream brand Mixue opened its first two outlets in Singapore. Beverage company Genki Forest has launched its flavoured sparkling water in the US and Singapore. Scarlett Supermarket which specialises in China-imported snacks is opening its 13th store in Singapore in less than two years, according to the company’s Facebook page.

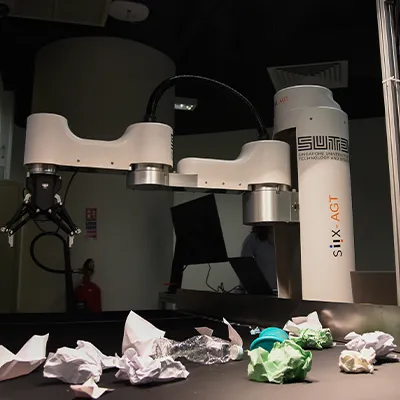

Beyond just e-commerce, we would expect these Chinese D2C brands to pilot new retail concepts, powered by technologies like Augmented Reality(AR), Virtual Reality and Artificial Intelligence. E-commerce giants JD.com and Alibaba have already rolled out AR features for product categories like footwear and cosmetics.

As the metaverse gains traction, the proficiency these Chinese brands have in retail innovation and market disruption may position them at the forefront of creating new immersive retail experiences in the network of 3D virtual worlds.

Shoppers may no longer simply be passive consumers but potentially, active participants in new retail concepts that would seamlessly connect both offline and online worlds.