Dr Xinhong Lim, Managing Director of Vickers Ventures and Chief Strategy Officer of RWDC, agrees, “The feedback from many of the consumer brand owners that we work with, is that they may have an initial engagement with you [as a synbio startup] but there’s very little else they will do if there is no line of sight to commercially viable production volumes, quality, and unit economics.”

This is a non-trivial challenge – to scale, synbio products and solutions require novel production infrastructure that is not readily available and often incur massive, fixed costs upfront. This is when companies find themselves entering what Chakrabarti calls the valley of death where they have matured beyond pre-seed and seed-stage funding but are still considered too risky by later-stage venture investors and hence cannot scale.

Governments can be the catalysts synbio needs

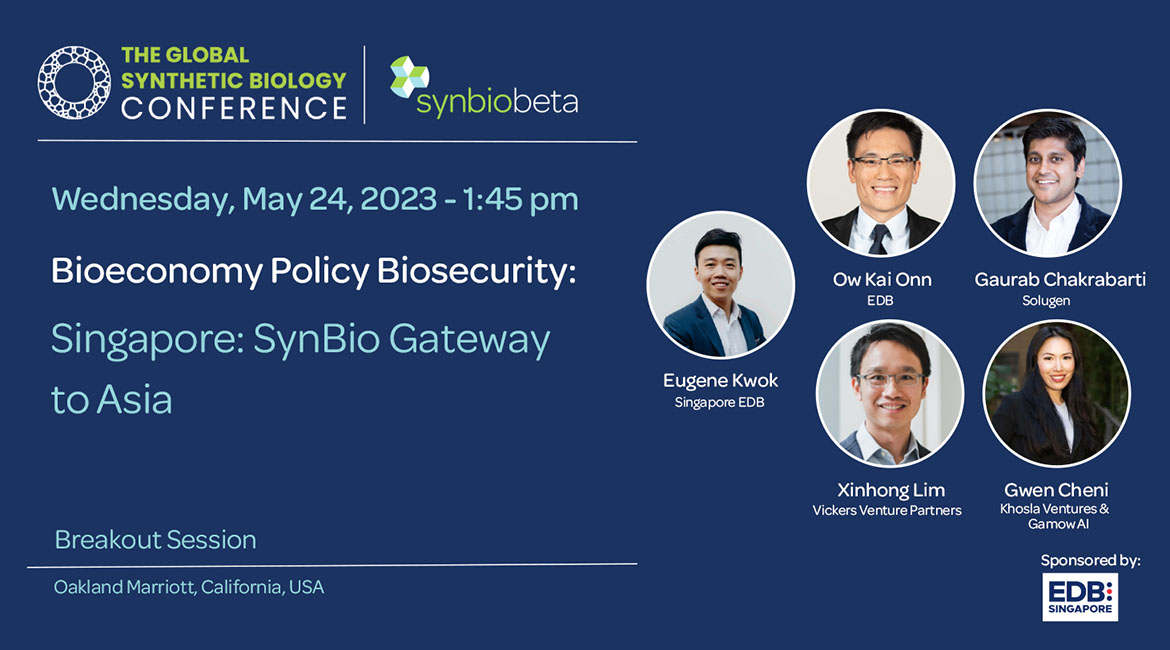

All four panellists agreed that synbio’s scale issue cannot be addressed by industry alone, and that governments would play an important role in de-risking investments and providing commercial-scale infrastructure.

Chakrabarti argued that governments could specifically explore de-risking funding mechanisms for mid-stage synbio companies in the valley of death. For example, the US Department of Energy provides loan guarantees for promising companies tackling climate change, which in turn give financial institutions the assurance needed to approve larger loans.

Separately, governments should consider providing shared “plug and play” infrastructure to help synbio startups reach commercial scale quickly. Ow Kai Onn, Vice President and Head of Chemicals and Materials at the EDB, shared that Singapore was already working on this for alternative proteins production, “We haven’t yet solved the issue at the 100,000 to 200,000 litre bioreactor level, but we are working with manufacturers in Singapore to create significant bioreactor capacity so that companies big or small can prove to a buyer that it can produce commercial volumes.” As an example, Mr Ow mentioned Esco Aster, who is currently designing three bioreactor trains with a combined capacity of 18,000 litres for cell culture operations, within a larger 50,000 litre “bioreactor farm.”

Gwen Cheni, Partner at Khosla Ventures and founder of a stealth-stage synbio startup, added that governments can provide highly practical assistance, such as free lab space for synbio startups.