The DPM also noted in his speech that electronic payments have been growing, even as the use of cheques has fallen sharply from 32 per cent of payments in 2016 to just 7 per cent currently.

The continued reliance on cheques has resulted in suboptimal business processes and contributes to a relatively high cost of payments in the economy. Wong said: “We aim to eliminate all cheques and terminate central cheque clearing over the medium term.”

MAS launched a public consultation on Wednesday, with several initiatives to eliminate corporate cheques by 2025, which would bring down a “substantial portion” of the local cheque transaction volume.

But Wong noted that there are still individuals, especially seniors, who are still uncomfortable with e-banking and e-payments.

“To ensure that our e-payment journey is inclusive, we will provide a longer runway for individuals to switch to alternative payment methods,” he said. “This will also give us more time to consider the right solutions for those who are unable to adopt e-payments and look into the necessary transitional support.”

The DPM also announced that the Singapore Financial Data Exchange (SGFinDex) would be extended to include insurance policies.

SGFinDex is the world’s first public digital infrastructure that enables individuals to securely access their financial information held across government agencies, banks, insurers and the central securities depository. There are currently more than 30,000 monthly active users of SGFinDex, with nearly 1.2 million data retrievals.

Jacquelyn Tan, UOB’s Head of Group Personal Financial Services, noted that their recent survey found that 80 per cent of Singaporeans indicated that sharing of financial data will help in financial planning.

She added: “With the next phase of SGFinDex, consumers in Singapore will greatly benefit from the addition of insurance data together with their consolidated savings and investment holdings.”

Prudential Singapore’s Chief Customer Officer Goh Theng Kiat said: “Customers will now have a single view of their finances, including their insurance policies, which will better support them in understanding their protection gaps when planning for their future.”

Wong said: “Going forward, we hope to on-board more financial institutions on this platform, as well as a wider range of financial information for more comprehensive overview and greater convenience in financial planning.”

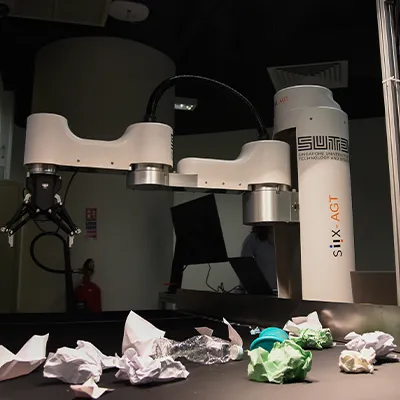

The government has also been looking at digital technologies to streamline and further improve business processes.